List of Contents

What is the Chemical Protective Gloves Market Size?

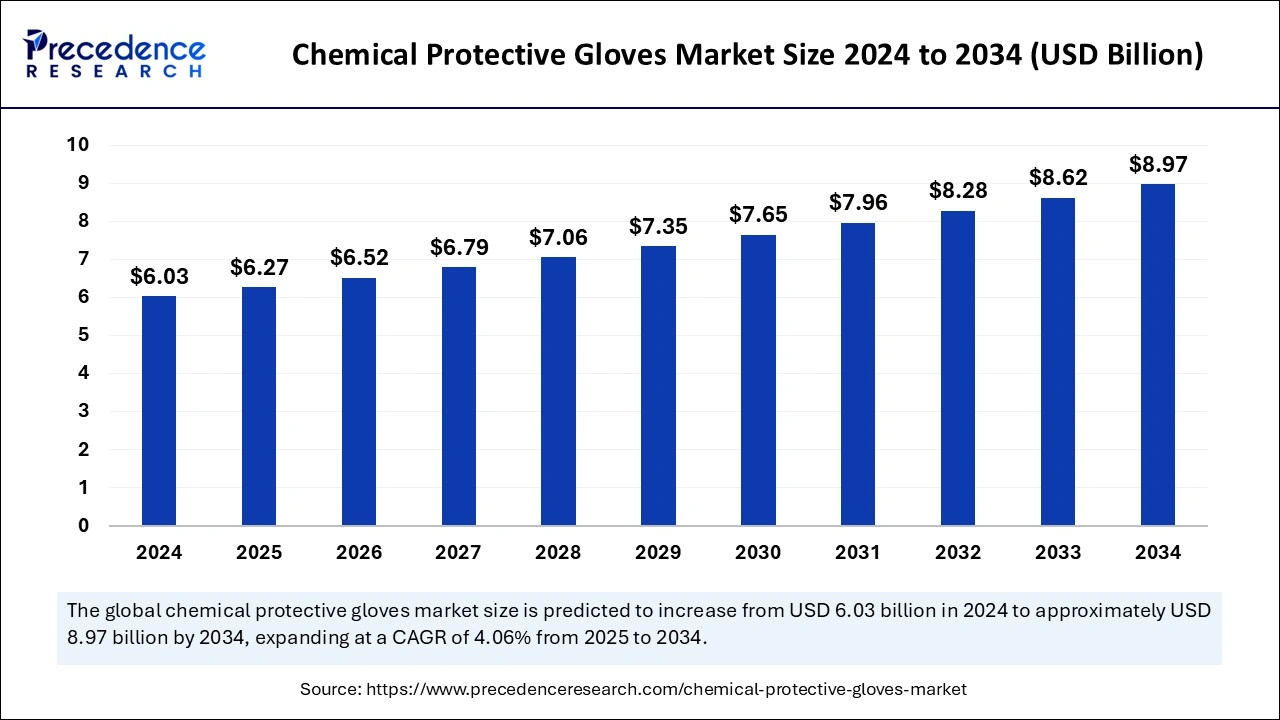

The global chemical protective gloves market size is valued at USD 6.27 billion in 2025 and is predicted to increase from USD 6.52 billion in 2026 to approximately USD 8.97 billion by 2034, expanding at a CAGR of 4.06% from 2025 to 2034. The demand for protective gloves has increased in various industries like chemical, pharmaceutical, and healthcare, leading to a boost in the global chemical protective gloves market. The rising awareness of safety in the workplace is fuelling the market growth. Additionally, growing industrial concerns for compliance with safety regulatory standards are expected to boost the market in the forecast period.

Chemical Protective Gloves Market Key Takeaways

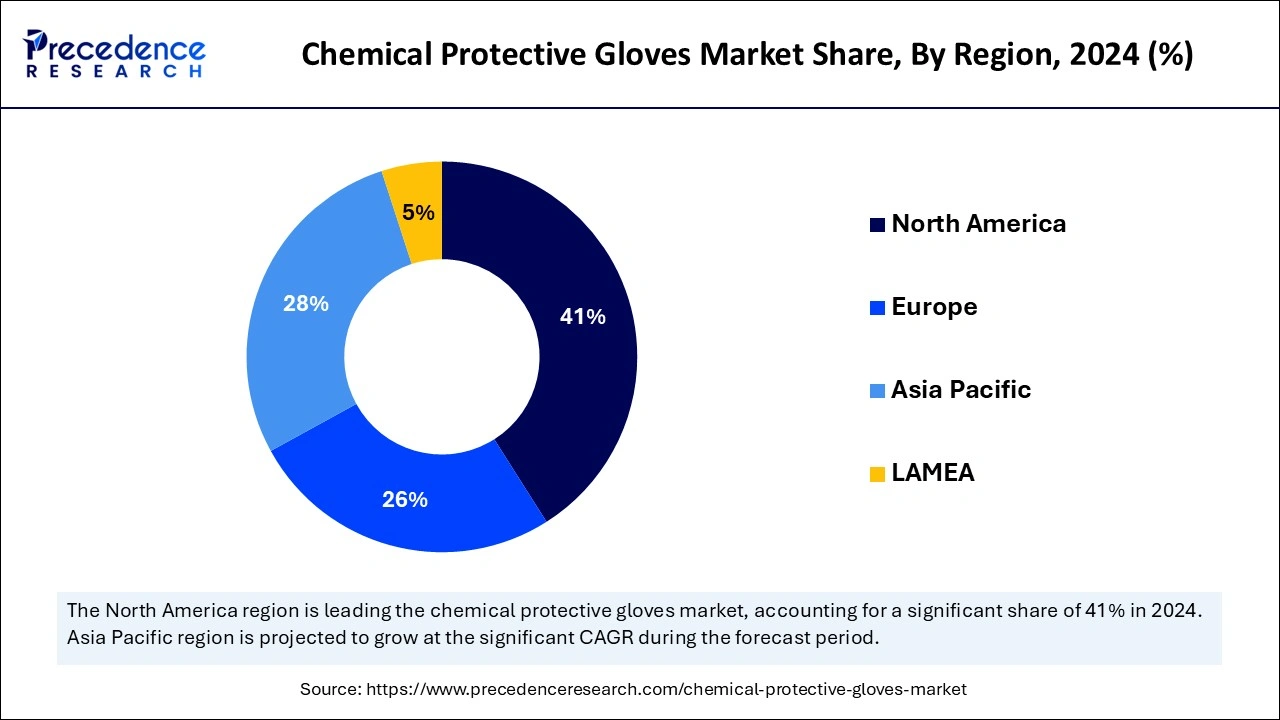

- North America dominated the global chemical protective gloves market with the largest market share of 41% in 2024.

- Asia Pacific is projected to expand at a notable CAGR during the forecast period.

- By product type, the disposable gloves segment generated the largest share of the market in 2024.

- By product type, the reusable gloves segment is projected to witness significant growth in the forecast period.

- By material, the nitrile segment captured the biggest market share in 2024.

- By material, the latex segment is expected to grow at a significant CAGR from 2025 to 2034.

- By application, the laboratory use segment contributed the highest market share in 2024.

- By application, the industrial use segment industrial use segment is expected to grow rapidly during the forecast period.

- By end-use industry, the healthcare segment has held the largest market share in 2024.

- By end-use industry, the chemical industry segment is predicted to be the fastest-growing segment during the forecast period.

Market Overview

Chemical protective or chemical resistance gloves are made with various raw materials, including rubber, natural butyl, neoprene, nitrile, and fluorocarbon. The rising awareness of safety and hazardous contamination in workplaces is driving a significant impact on the global chemical protective gloves market. The utilization of such gloves has witnessed growth in healthcare, hospitals, and pharmaceutical industries. Manufacturing industries are focusing on complying with safety regulatory standards to overcome regulatory compliance and improve quality assurance.

The rising industrialization has increased the need for such gloves. Additionally, the government has made the completion of wearing personal protective gloves, including chemical protective gloves, mandatory in certain industries. The rising demand for customized and sustainable gloves is holding significant market potential. Additionally, technological advancements are helping to overcome skin irritation and allergic challenges, opening chances for more adoption. Furthermore, with rising initiatives and investments in R&D by key companies, governments, and regulatory frameworks, the market is expected to witness the development of innovative products in the upcoming period.

- In June 2024, ISO adopted EN ISO 21420 to become a worldwide standard. The stands include protective gloves, arm protectors, gloves permanently incorporated in containment enclosures, mittens, and pot holders.

Artificial Intelligence (AI) Impact on the Chemical Protective Gloves Market

The implementation of Artificial Intelligence technologies in the manufacturing and design of chemical protective gloves is significantly transforming the global chemical protective gloves market. Due to increased safety concerns and awareness in workplaces, the demand for protective gloves has top surged. The rising demand for customized gloves is emerging in the market. AI integration is making such development easier.

AI is acutely aware of the rising demand for sustainable and eco-friendly chemical protective gloves. The ability of AI to reduce cost, improve quality, and comply with regulatory standards is the key factor behind its integration into production industries. With the help of AI integration, the chemical protective gloves market is likely to witness novel room for improvements and growth.

Market Outlook

- Industry Growth Overview: The chemical protective gloves industry is experiencing strong growth as strict workplace safety rules and increased chemical exposure awareness drive demand across the chemical, pharmaceutical, oil & gas, and manufacturing sectors. Improvements in glove materials (such as reinforced nitrile, neoprene, and multilayer designs), ergonomic enhancements, and a greater focus on protective performance are encouraging wider use and longer-lasting wear. At the same time, industrialization in emerging regions and the rising need for healthcare and laboratory safety are fueling market expansion.

- Sustainability Trends: Sustainability trends are driving a rapid shift toward biodegradable and recyclable materials, increased use of eco-friendly packaging made from post-consumer waste, and the development of reusable glove options, fueled by growing regulatory pressures and corporate environmental commitments.

- Global Expansion:The market is growing worldwide due to strict workplace safety laws, increasing industrialization in developing areas, greater awareness of chemical dangers, and innovations in ergonomic, long-lasting, and eco-friendly glove materials.

- Major Investors: Leading companies in the safety equipment market include large corporations like Ansell Ltd., Honeywell International Inc., and 3M Company, each expanding capacity and product innovation by investing heavily. Key investment focuses are strategic acquisitions, sustainable material development, and scaling global distribution.

- Startup Ecosystem:The startup ecosystem in the market is growing, with niche innovators creating biodegradable materials, embedded-sensor “smart” gloves, and customization platforms for industrial users. These companies collaborate with major PPE manufacturers and attract venture capital focused on sustainable workplace safety solutions.

Chemical Protective Gloves Market Growth Factors

- Rising awareness in workplaces: The growing awareness regarding safety in workplaces is driving the adoption of chemical protective gloves.

- Expanding industries: The growing industries, including chemical, pharmaceutical, healthcare, and hazardous, are requiring safety alliances, including chemical protective gloves.

- Safety regulation and standards: The regulatory safety standards and protocols are making it essential for industries to comply with them, which is raising the demand for protective gloves.

- Technology advancements: The growing development of innovative, high-performance novel materials and glove designs is contributing to the market expansion.

- Sustainability: The rising shift toward sustainability has raised the demand for sustainable and eco-friendly chemical protective gloves, creating the potential for the market to expand in upcoming years.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 6.27 Billion |

| Market Size in 2026 | USD 6.52 Billion |

| Market Size in 2034 | USD 8.97 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.06% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Material, Application, End-use, and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. |

Market Dynamics

Drivers

Rising industrialization

The rising chemical industries are driving demand for protective gloves worldwide, leading to the expansion of the chemical protective gloves market. The increased industrialization has led to a vast amount of manufacturing, which certainly requires workplace safety. The rising petrochemical industries involve hazardous chemicals, which have enhanced demand for chemical protective gloves. To comply with regulatory safety standards, the need for safety alliances, including protective gloves, is highlighting the industries. The adoption of advanced manufacturing technologies in manufacturing industries requires high-quality chemical protective gloves.

Restraint

High cost and skin allergies

The chemical protective gloves are made of several raw materials, including nitrile, butyl, neoprene, PVC, latex, and Viton, which are costly. Additionally, the price of raw materials is fluctuating, which impacts the overall cost of chemical protective gloves. Additionally, skin allergies can also hamper the adoption of the chemical protective gloves market. Chemical protective gloves can cause skin allergies and irritation in people sensitive to latex, butyl, and nitrile.

Opportunity

Stringent safety regulations

The rising safety regulation focus and encouragement for the use of personal protective gloves, including chemical protective gloves, are holding market potential. The expanding chemical, healthcare, and pharmaceutical industries are focusing on complying with regulatory standards, which leads to the adoption of chemical protective gloves. Additionally, regulatory initiatives and investments in R&D are encouraging manufacturers to develop innovative and high-performance materials for chemical protective gloves. The rising safety awareness in workplaces is further driving a surge to comply with stringent safety regulations.

Product Type Insights

The disposable gloves segment generated the largest share of the chemical protective gloves market in 2024. This is attributed to the easy and convenient use of disposable gloves. The growing demand for disposable and cost-effective chemical protective gloves in healthcare and laboratories is the key contributor to segment growth. Additionally, disposable gloves are recyclable, which increased their popularity among sustainability-conscious users. Users are continuously seeking efficient and cost-effective gloves for maintenance.

On the other hand, the reusable gloves segment is expected to witness significant growth over the forecast period. Reusable gloves allow extended use of gloves to protect from hazardous chemicals. It provides extreme durability as well as comfort. The major reason behind segment expansion is the growing shift toward sustainability and reducing environmental impacts.

Material Insights

The nitrile segment captured the biggest chemical protective gloves market share in 2024 due to its durability and versatility. Nitrile materials are excellently resistant to chemicals, oils, and fuels and are affordable compared to other materials. The segment growth is also highlighted due to increased innovations in nitrile materials. The affordability and durability of nitrile have made it a priority in manufacturing companies, and ongoing research and development of the segment is projected to continuously dominate the market.

- In May 2024, Kimberly-Clark Professional™ announced that its Kimtech™ Polaris™ Nitrile Exam Glove received the Accountability, Consistency, and Transparency (ACT) Environmental Impact Factor Label from My Green Lab, a non-profit environmental organization dedicated to building a global culture of sustainability in science.

- In July 2024, Unigloves (UK) Ltd. collaborated with KluraLabs on the development of the CrossGuard antimicrobial nitrile glove, which is designed to reduce 99.99% of selected bacteria within 60 seconds.

On the other hand, the latex gloves segment is expected to grow at a significant CAGR from 2025 to 2034 due to its comfort and flexibility. Latex materials are flexible, which provides great comfort and mobility. The ability of chemical resistance and cost-effectiveness have made the material popular in glove manufacturing. Additionally, ongoing innovations to reduce the allergic characteristics of latex materials are expected to generate future potential for the segment.

Application Insights

The laboratory use segment contributed the highest chemical protective gloves market share in 2024 due to increased demand for chemical protective gloves in research activities. The rapid research activities performed in laboratories, including pharmaceuticals and chemicals, require protective and safety gloves. Additionally, stringent safety regulations to comply with laboratory protocols contribute to the segment's growth.

However, the industrial use segment is expected to grow rapidly over the forecast period due to growing industrialization and expanding industrial activities, including manufacturing in oil, gas, and chemical productions. The demand for durable and disposable gloves is high in many industries. The rising employee concern for safety in workplaces has enhanced the demand for chemical protective gloves in the industries.

End-User Insights

The healthcare segment held the largest chemical protective gloves market share in 2024. The segment growth is derived from the increased number of healthcare professionals, rising concern for infectious disease, the need for protection and compliance with regulatory standards, and increased incidences of hazardous exposures. The increased knowledge and understanding of personal safety in the healthcare sector.

On the other hand, the chemical industry segment is expanding rapidly due to increased chemical manufacturing industries. The rising construction, automotive, and R&D activities have enhanced chemical activities, which are demanding extreme safety gloves. The increased awareness of hazardous chemicals and regulatory safety standards in chemical industries is expanding the segment.

Regional Insights

What Made North America the Dominant Region in the Chemical Protective Gloves Market?

North America dominated the global chemical protective gloves market due to the presence of well-established industrialization in the region. The government and regulatory initiatives for workplace safety standards are contributing to this growth. The United States is leading the regional market due to several reasons, like stringent regulations, growing safety awareness of workplaces, the presence of key competitors, and a large industrial base in the country.

The continuous innovation of cutting-edge features with customization. The availability of high disposable income in the country further fuels the adoption of personal protective gloves, including chemical protective gloves. The growing shift toward sustainability is further emerging in the market. In addition, stringent safety regulations are playing a crucial role in the U.S. market.

- In October 2024, Ansell, a U.S.-based personal protective equipment (PPE) company, introduced AlphaTec 53-002 and 53-003 new chemical-resistant gloves. In the same month, the company also won the 2024 Best New Product of the Year award from Occupational Health & Safety (OHS) in the Hand Protection: Chemical/Liquid category.

What Makes Asia Pacific a Notably Growing Area?

Asia Pacific is projected to expand at a notable CAGR during the forecast period due to rapidly growing industries and increased utilization of chemicals. The expanding healthcare and pharmaceutical companies in the region are driving the need for chemical protective gloves. Moreover, government initiatives and investments in industrial developments are allowing for the affording of cutting-edge technologies and appliances in the industries, including chemical protective gloves.

China is leading the regional market due to the rapidly growing industrialization and urbanization of the country. The growing construction sector is playing a major role in this growth. Additionally, rising hazardous manufacturing industries and awareness of employees regarding safety matters have enhanced the adoption of personal protective gloves, including chemical protective gloves, in the country. China is the major supplier of gloves in Asia. However, with growing government initiatives and investments in industrialization and technology advancements, Asia is witnessing significant growth in Southeast Asian countries, including India, Vietnam, Myanmar, and the Philippines.

How Big is the Success of Europe in the Chemical Protective Gloves Market?

The chemical protective gloves market has been expanding rapidly due to strict workplace safety regulations, increasing industrial automation, rising chemical manufacturing activities, and growing adoption of advanced materials such as nitrile and neoprene. Additionally, emphasis on ergonomics, sustainability, and clean-label compliance drives demand across pharmaceuticals, laboratories, and manufacturing sectors.

The UK dominates the market in Europe because of strict workplace safety rules, high awareness of chemical hazards at work, and widespread use of advanced glove technology. Strong pharmaceutical, laboratory, and manufacturing industries, along with a focus on ergonomic and sustainable PPE, further boost market growth across the region.

How Crucial is the Role of Latin America in the Chemical Protective Gloves Market?

Latin America plays a vital role in the market, driven by its growing chemical, oil & gas, and manufacturing sectors, along with increasing workplace safety awareness and stricter regulations. Rising industrialization, the adoption of advanced materials like nitrile and neoprene, and increasing demand for ergonomic, durable, and sustainable gloves further propel regional market growth. Brazil leads the market due to its large industrial base, including the chemicals, oil & gas, and manufacturing sectors. Strong regulatory enforcement and increasing workplace safety awareness are boosting the adoption of ergonomic and sustainable glove solutions.

How Big is the Opportunity for the Growth of the Chemical Protective Gloves Market in the Middle East and Africa?

The Middle East and Africa (MEA) offer significant opportunities in the market, driven by expanding industrialization, rising manufacturing activity, greater workplace safety awareness, and government policies encouraging the use of protective equipment. The rising demand for ergonomic, durable, and sustainable gloves further boosts market potential. The UAE leads the market thanks to its strong industrial and petrochemical sectors, strict enforcement of workplace safety regulations, high adoption of innovative and ergonomic glove technologies, and its strategic location as a trade and logistics hub that supports regional distribution and supply chain efficiency.

Value Chain Analysis

- Feedstock Procurement

In this stage, raw materials such as natural rubber, nitrile, neoprene, and polyurethane are sourced from plantations, chemical suppliers, or petrochemical facilities. Materials undergo quality checks and are transported to manufacturing plants under controlled conditions.

Organizations: Rubber plantations, petrochemical companies (e.g., BASF, Dow Chemicals), and specialty raw-material suppliers. - Chemical Synthesis and Processing

Feedstocks are processed into glove-grade polymers via compounding, vulcanization, and molding. Chemical additives are incorporated to enhance elasticity, chemical resistance, and durability, followed by surface treatments for improved grip.

Organizations: Glove manufacturers such as Ansell Ltd., Top Glove Corporation, Hartalega Holdings, Kossan Rubber Industries, and Honeywell International. - Waste Management and Recycling

Production residues, defective gloves, and chemical by-products are collected, segregated, and treated through recycling, energy recovery, or safe disposal methods. Solvents and water from processing are reused where feasible to reduce environmental impact.

Organizations: Industrial waste management firms, bio-waste recycling companies, and in-house environmental teams. - Regulatory Compliance and Safety Monitoring

Gloves are tested for chemical resistance, tensile strength, and permeability per international standards. Compliance with OSHA, EN 374, ASTM, and REACH regulations is ensured, alongside continuous workplace safety monitoring for employees.

Organizations: Regulatory bodies such as OSHA (USA), the European Chemicals Agency (ECHA), the Bureau of Indian Standards, and the internal quality/safety departments of glove manufacturers.

Chemical Protective Gloves Market Companies

- 3M: 3M contributes to the chemical protective gloves market by providing advanced, high-performance gloves designed to protect against hazardous chemicals, enhancing worker safety across various industries.

- Ansell: Ansell offers a wide range of chemical protective gloves with superior resistance to chemicals and punctures, meeting the needs of industries such as healthcare, manufacturing, and chemicals.

- Kossan: Kossan is a leading manufacturer of chemical-resistant gloves, delivering durable and high-quality protective gloves to safeguard workers in chemical handling and industrial settings.

- RSA Protective Technologies: RSA Protective Technologies specializes in creating chemical-resistant gloves that provide reliable protection for workers in hazardous environments, such as chemical plants and laboratories.

- Aurelia Gloves: Aurelia Gloves produces a variety of chemical-resistant gloves, focusing on safety and comfort for users handling hazardous materials in industrial and healthcare sectors.

- Honeywell: Honeywell supplies chemical protective gloves designed for extreme environments, offering advanced materials and technology for superior chemical and mechanical protection.

- Pull on Protection: Pull on Protection offers chemical-resistant gloves that provide enhanced protection and comfort for workers in industries handling hazardous substances.

- Cestusline: Cestusline manufactures chemical protective gloves that combine durability, dexterity, and comfort, offering robust protection for workers in construction, manufacturing, and chemical processing.

- DuPont: DuPont offers chemical-resistant gloves made from cutting-edge materials like Tyvek, providing effective protection against a wide range of hazardous chemicals.

- Microflex: Microflex produces premium chemical protective gloves designed for high-risk environments, ensuring worker safety against toxic substances and harmful chemicals.

- MCR Safety: MCR Safety provides chemical-resistant gloves that combine strong chemical protection with comfort and flexibility, catering to various industries such as agriculture, pharmaceuticals, and manufacturing.

Latest Announcements by Industry Leaders

- In May 2024, Anuj Sinha, General Manager, Global Scientific, stated that the company has decided to go through the ACT certification process with our Polaris Nitrile Glove to offer consumers visibility in the company's supply chain integrity and to bring more transparency.”

- In November 2024, Dr. Andrew Funk, chair of the ISEA Hand Protection Product Group and senior laboratory manager at Wells Lamont Industrial, announced that “ANSI/ISEA 105-2024 standards do not make any large changes to test methods of protection, but the product labeling does.”

Recent Developments

- In February 2024, Ansell launched a new nitrile disposable glove designed for industrial workers called MICROFLEX Mega Texture 93-256 to protect against chemicals, oils, grime, and carcinogens.

- In November 2024, the International Safety Equipment Association (ISEA) released updates to the standard for hand protection products, the new ANSI/ISEA 105-2024 American National Standard, which brings uniformity to the ways manufacturers display a glove's levels of protection.

- In May 2024, Ansell Limited acquired Kimberly-Clark Corporation's Personal Protective Equipment business. The completion of the acquisition was expected to occur on 1 July 2024 (United States Eastern Daylight Time), subject to customary closing conditions.

Segments Covered in the Report

By Product Type

- Disposable Gloves

- Reusable Gloves

- Extended Cuff Gloves

- Cut-Resistant Gloves

By Material

- Nitrile Gloves

- Latex Gloves

- Viton Gloves

- Neoprene Gloves

By Application

- Laboratory Use

- Industrial Use

- Medical Use

- Hazardous Waste Handling

By End-use

- Chemical Industry

- Healthcare

- Manufacturing

- Automotive

By Geography

- North America

- Europe

- Asia Pacific

- Middle East and Africa

- Latin America

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client