List of Contents

What is the Bake Stable Pastry Fillings Market Size?

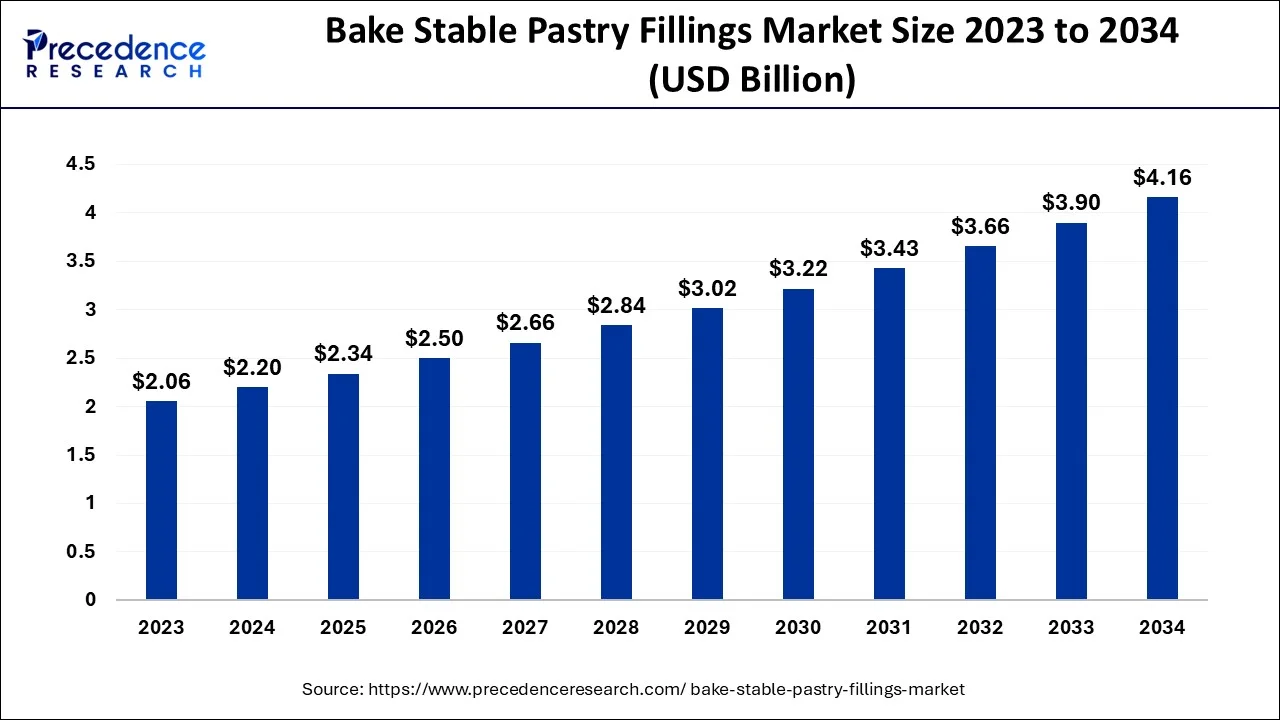

The global bake stable pastry fillings market size is valued at USD 2.34 billion in 2025 and is predicted to increase from USD 2.50 billion in 2026 to approximately USD 4.16 billion by 2034, expanding at a CAGR of 6.58% from 2025 to 2034.

Bake Stable Pastry Fillings Market Key Takeaways

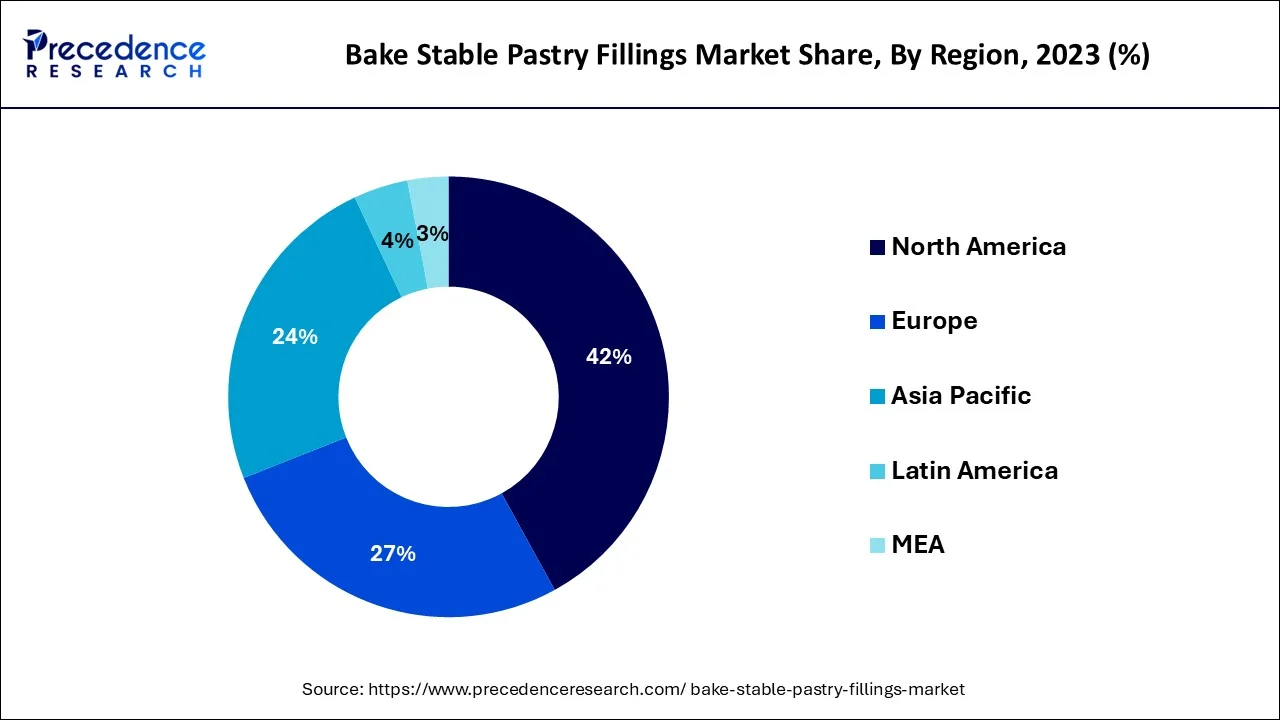

- Europe region dominant global market and generated more than 42% of the revenue share in 2024.

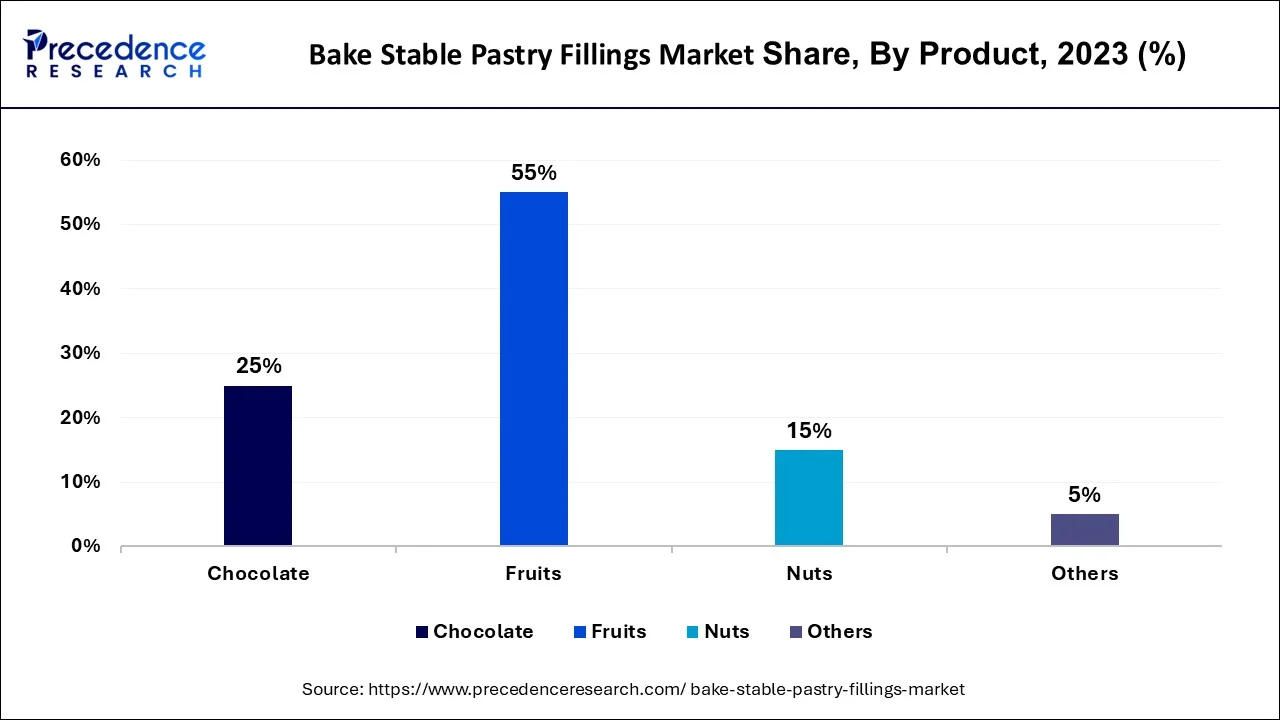

- By product, the fruits segment dominated the market and captured more than 55% of the revenue share in 2024.

- By distribution channel, the offline segment led the market.

Market Overview

Applying baked pastry filling to the dough gives it a creamy texture and a crisp exterior layer; it also prevents melting when baking. Nowadays, consumers choose products that retain freshness and sensory qualities while being free of microbial growth, toxins, and other elements that degrade quality. The goal of innovation in bakery supplies is, among other things, to improve the nutritional profile of the goods and reduce their calorie density.

Consumers are becoming more aware of calorie content and the demand for healthier food options. Overall, industry competitors are responding to consumer demand for healthier substitutes for their favourite cuisines. Due to rising consumer demand for various bakery product flavours, the baked pastry filling is expected to expand rapidly. Advances in determining the relationship between nutrition and health, frequently at the molecular level, gave rise to functional foods.

Today's meals are created to sate hunger, provide vital human nutrients, guard against diseases linked to poor nutrition, and enhance customers' physical and mental health. Consumer spending on pastry-filling products is influenced by the rising popularity of fruit flavours in sweets. Introducing new fruit flavours, such as bananas and pomegranates, affected the customer. A dairy product made from cow or goat milk; the cream is produced.

The reduced density of fat globules in fresh milk causes the cream to float spontaneously to the top when it isn't homogenized. It is then easily skimmed from the top for butter, sour cream, or whipped cream. Before milk is homogenized, a layer of fatty liquid known as cream forms on top of it. The cream is separated using a continuous centrifugation technique. It is used in frostings, custards, and cream fillings for pastries. People now purchase prepared foods more frequently due to rising disposable income and global urbanization, which makes preparing breakfast quickly possible. As a result, there is an increase in global spending on sweets and baked goods such as crackers, cakes, muffins, and pastries.

In addition, the market players. Also, to satisfy consumer demand, market participants concentrate on new product releases and innovation. Under the Craigmilla brand, CSM Bakery Solutions, a European company, introduced four new filling flavors in 2019: raspberry, vanilla, lemon, and chocolate. The basis for more than 80% of all products consumed in the EU is bread. From 2012 to 2016, the demand for bakery products rose to new heights, driven by pre-packaged goods, while fresh finished goods and bake-off goods accounted for the majority of sector sales.

Pre-packaged loaves of bread represent one of the most significant and focused segments in Eastern Europe, primarily driven by surging demand within supermarkets. Consumers in the Western half of Europe have discovered an alternative to bread and instead favor ready meals, pizza, frozen baked goods, and other instant items.

Customers buy industrial bread of the highest quality, but they also acknowledge the less expensive white bread on grocery shelves. The latter has been noted as a significant cause of the decline in demand for artisan bread goods. However, consumers' preferences for pre-packaged, oven-fresh, bake-off, and non-perishable goods have changed over time, impacting how well artisan bakeries perform.

Nonetheless, given Eastern Europe's good consumption pattern of fresh bread, the promising future for freshly made bread products cannot be understated. Bakery markets in Germany, France, Italy, and Spain are anticipated to see a new fresh-bake boom thanks to mass manufacturing by artisan bakers.

Bake Stable Pastry Fillings Market Outlook

- Industry Growth Overview: The bake stable pastry fillings market is expected to grow rapidly between 2025 and 2034, driven by rising bakery production and rising demand for convenient, ready-to-bake products. The growth drivers include urbanization, changing lifestyles, and increasing demand for premium and artisanal bakery products by consumers. Asia-Pacific, especially India, China, and South Asian countries, is quickly becoming a key growth hub due to the expanding foodservice and retail bakery industries.

- Innovation & Quality Trends

Product innovation remains a crucial process as manufacturers focus on fillings that maintain texture, flavor, and appearance during high-temperature baking. It also shows a trend toward clean labels, natural ingredients with less sugar, and minimal use of synthetic stabilizers to meet the needs of health-conscious customers. Pectin, modified starches, and plant-based emulsifiers are increasingly added by companies to enhance heat stability, moisture retention, and shelf life. - Global Expansion

Market leaders are planning to expand production and distribution facilities to serve industrial bakeries, patisseries, and food service operators in emerging regions. Rising disposable incomes, shifting urban lifestyles, and increased bakery consumption are driving adoption in Southeast Asia, Latin America, and the Middle East. Additionally, the growing use of frozen and ready-to-bake bakery products in supermarkets and convenience stores is encouraging manufacturers worldwide to localize production to reduce costs and lead times. - Startup/Innovation Ecosystem

The startup ecosystem within the bake-stable pastry fillings industry is evolving rapidly, especially in European, Indian, and North American regions, where small companies are carving out niche solutions. Natural, organic, and plant-based fillings; thermally stable products that can be used in industrial and artisanal baking are also attracting startup attention. New firms are utilizing R&D to develop innovative products that meet consumer demands for clean labels, low sugar, and allergen-free ingredients. These trends show that the market is shifting toward innovation-driven growth.

Growth Factors

New and innovative food items drive a quick shift in customer eating patterns, enhancing the market for bake-stable pastry fillings. Favorable conditions like urbanization, changes in food choices, and the company's new ways of producing and processing crucial food factors fueling the demand. Users spending on packaged food drives the economy. Due to rising consumer interest in various flavors, the pastry fillings and bake-stable characteristics market is predicted to increase significantly throughout the coming years. The need for baked stable pastry fillings is accelerating due to rising expenditure on cakes, tarts, etc.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 2.34 Billion |

| Market Size in 2026 | USD 2.50 Billion |

| Market Size by 2034 | USD 4.16 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 6.58% |

| Largest Market | Europe |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Product and By Distribution Channel |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Market Drivers

Busy and fast-paced lifestyle.

International market demand for sugar and gluten-free, vegan food, and organic food has risen as public demand to lead healthy and sustainable life by choosing products for healthier and more vegan options. During the COVID-19 outlook, the public depends on food to enhance their mood and work on stress levels. Rising foreign influence has resulted in a growing bake stable fillings market by celebrating birthdays, engagements, weddings, etc., by including cake as one of the main dishes.

Market Restraints

Training working staff about the baked goods by offering samples of properly prepared products, educating them about every detail, starting from the flavor, color, taste, ingredients etc., so that the sales staff can easily acknowledge them if not appropriately addressed may result in loss of sales. Bakeries are inspected by food health authorities and graded based on the category they need to fulfill to get a good score. By learning those given grades usually, customers visit the place. Negative feedback shows the consumer's view of the quality of the bakery. Poorly functional bakeries waste food ingredients and labor, increasing expenses and reducing profit margins; also, preliminary apparatus results in the waste loaves of bread needing to be correctly baked.

Market Opportunities

Involvement of 3D bread quality x-rays.

When the bread is produced on a bulk scale, it seems impossible to understand the performance inside of the loaf and bread makers deal with a significant issue when a hole is formed due to ignorance in the fermentation process. To solve this issue, 3D X-ray, food inspection technology, has come into action, and its scans the bread and provides a 3D digital model which reflects inside imperfections that comes with an automated rejection that rejects the defective loaves and removes them from the production line by ensuring only the best quality products enter the bakery.

Vacuum cooling chambers.

Vacuum cooling offers an alternative to traditional cooling, which is inefficient and potentially harmful. It helps counter the problem by extracting moisture and heating it much faster as the baked products are put in the vacuum chamber after being removed from the oven. The boiling point for water changes due to increased pressure, causing the baked goods to evaporate water content. The products cool down faster and prepare for packaging. It saves the whole baking time by allowing production on a significant scale.

Hydro bond technology.

Baking can go wrong in multiple ways, such as while mixing the dough. Hydro bond technology enables making a perfect dough all the time by evenly hydrating it without adding heat to the entire mixture before it enters the vast container. This leads to less time consumption, equal moisture distribution, and the least energy wasted. All the new innovative techniques in the baking industry help in the exponential growth of the bake-stable pastry fillings market globally.

Product Insights

The fruits section dominated the market and generated more than 55% of the revenue share in 2024. Fruits retain sugar contents, making the bakery product healthier; thus, a rise in hygiene awareness throughout the pandemic has led to an increasing consumer focus on establishing and maintaining a fit immune system consuming fruits rich in vitamins and antioxidants.

Consumers want food products that elevate the eating experience and provide nutritional benefits. Nuts enhance energy-boosting; thus, growth in the need for bake-stable products with dietary benefits is accounted to fuel the market.

Distribution Insights

The offline segment dominated the bake-stable pastry fillings market revenue share as the public prefers to walk to the door and choose directly from the shop. This increase in offline features is due to the rising availability of various providers to the client and vice versa. The increasing number of malls, supermarkets, and general stores plays a vital role in accelerating the growth of this segment. Moreover, customers can ensure product quality through offline channels.

Regional Insight

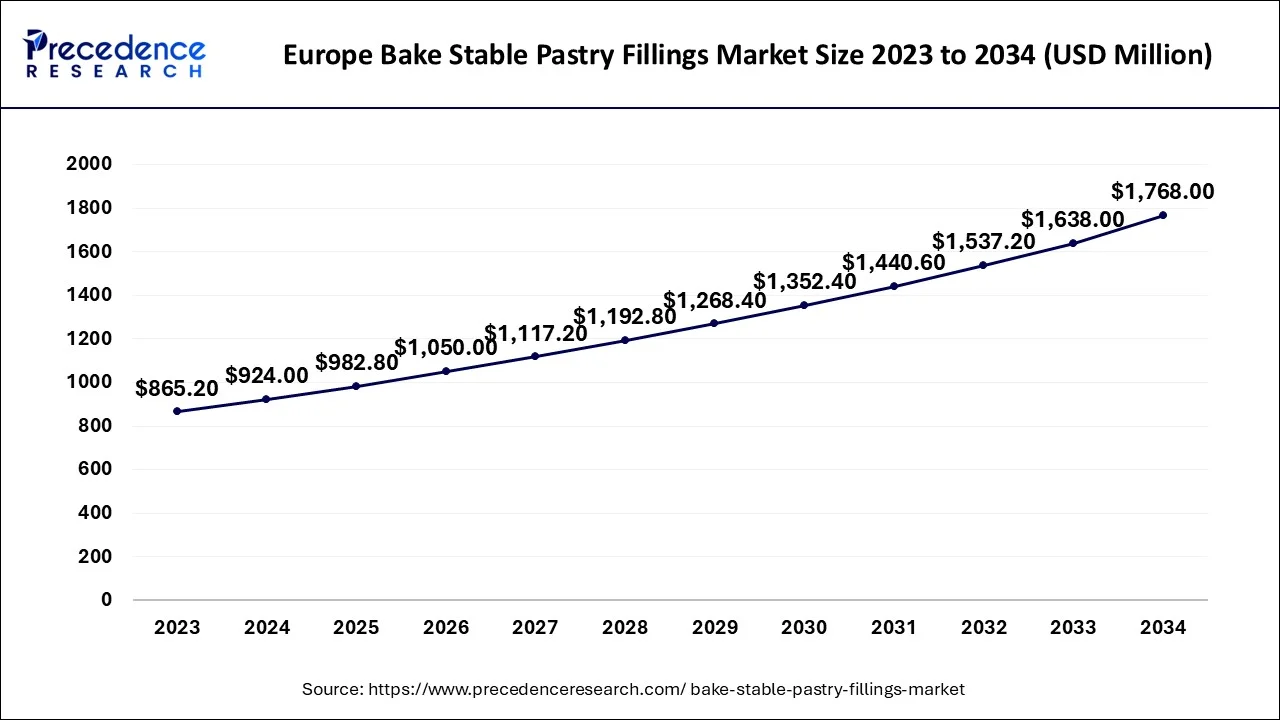

Europe Bake Stable Pastry Fillings Market Size and Growth 2025 to 2034

The Europe bake stable pastry fillings Market size is estimated at USD 983 million in 2025 and is expected to be worth around USD 1,768 million by 2034, rising at a CAGR of 6.70% from 2025 to 2034.

Europe's dominant baker market resumes gaining traction due to maximum consumption. Manufacturers focus on new experimentation, innovation, and product development, such as whole wheat, whole grain, high-fibre, non-allergen, sugar and gluten-free, and low-fat. Due to robust domestic production and economical food pricing, anti-oxidants like almonds are considered the top nut for European vegans, leading by a large margin compared to other nuts.

Germany Bake Stable Pastry Fillings Market Trends

Germany leads the market in Europe. The country benefits from a strong bakery tradition combined with large industrial operations. The demand for high-quality and convenient bakery products is high, prompting manufacturers to develop standardized and reliable fillings. Food safety and quality regulations support the consistent use of, ingredients. Overall marketing efforts are boosted by the growth of retail bakery chains.

What Factors are Responsible for the Rapid Growth of the Market in Asia Pacific?

Several factors contribute to the Asia Pacific region's rapid growth, including the region's overpopulation, the relative affordability of foods compared to other goods, and the spread of western lifestyles. Even better logistics and transportation and quickly expanding retailers help the market for baked goods flourish by providing great chances for development, innovation, and job creation. India is a significant player internationally and the third-largest manufacturer of biscuits after the United States and China.

It is one of the fascinating places for the bread industry because of the innovative spirit of Indian businesses and people. Indian consumers' evolving tastes, preferences, and western lifestyle influence impact the bakery sector of the country. Bakery goods are now more frequently consumed daily rather than as a treat. So there is an increasing need for healthier products and alternatives as part of a global trend. Due to high consumption rates, consumers are looking for guilt-free baked goods with fewer calories and sugars and more and more gluten-free products with alternative ingredients like whole-wheat and multigrain.

In addition to healthier options, flavor innovation is essential because millennials are constantly looking for new flavors and experiences. Indian consumers emphasize convenience due to their hectic lifestyles, and since loaves of bread and biscuits are popular fast-moving consumer goods, bakeries are a popular choice. Although there is a demand and taste for baked goods among Indian customers, the country's bakery industry faces unique difficulties.

Operational effectiveness and the need for more technology and qualified people are significant issues in the sector. Organized bakeries in India actively engage in social media marketing to deliver focused and affordable marketing. Smaller bakeries can prioritize quality over quantity because they lack the enormous budgets and resources of worldwide chains and local bakery-cafés, who instead rely on word-of-mouth recommendations rather than social media marketing and social media interaction. Even though obstacles are causing losses, there has still been a boom in entrepreneurial endeavours in the bakery sector.

How is the Opportunistic Rise of North America in the Bake Stable Pastry Fillings Market?

North America is experiencing significant growth in the market due to increasing demand for pastry fillings in the industrial bakery sector and a growing preference for ready-to-bake products. The trend toward premiumization is driving the need for consistent, high-quality fillings that can withstand baking conditions. Foodservice operators and retail bakeries are also adopting bake-stable fillings that ensure product reliability and extend shelf life. Further expansion is expected to continue, supported by investments in R&D focused on improving texture, flavor retention, and clean-label ingredients.

U.S. Bake Stable Pastry Fillings Market Trends

The large industrial bakeries and the dominance of frozen bakery chains support the U.S. market. The trend of increased premiumization encourages the use of consistent, high-quality fillings. Foodservice and retail bakeries are adopting heat-stable fillings in greater numbers to ensure the reliability of their products. Growth is being driven by investment in R&D focused on texture, flavor retention, and clean-label ingredients.

What Factors Contribute to the Growth of the Market in Latin America?

The bake stable pastry fillings market in this region is expected to grow due to the increasing bakery and foodservice industries and the rising popularity of convenience products. Adoption of retail and foodservice bakeries is growing in countries like Mexico and Brazil. Local production is anticipated to improve supply chain efficiency through investment in regional facilities. Additionally, the expansion of supermarket chains and the distribution of frozen bakery products further boost market growth.

Mexico Bake Stable Pastry Fillings Market Trends

The market in Mexico is growing due to a high level of industrial and retail bakery activity. Rising disposable incomes and an increasing urban population are boosting demand for ready-to-bake and premium bakery products. Manufacturers are investing in production facilities to improve supply chain efficiency. The market presence is being strengthened through strategic partnerships between global ingredient suppliers and local bakeries.

How Big is the Opportunity for Market Expansion in the Middle East and Africa?

The Middle East and Africa present significant growth opportunities for market expansion due to increasing urbanization, the rising number of bakery restaurants, and growing demand for convenience bakery products. Changes in urban lifestyles and higher disposable incomes are fueling the demand for ready-made bakery items and more luxury bakery products. Additionally, the growth of the hospitality and retail industries is further boosting demand. Food quality and safety are being enhanced through regulation, which is encouraging the adoption of standard fillings.

UAE Bake Stable Pastry Fillings Market Trends

The market in the UAE is expanding due to high penetration of modern bakeries, hotels, and foodservice chains. The demand for ready-to-bake and high-quality bakery products is driven by urban lifestyles and rising disposable incomes. Availability of these products is improving through imports and local production growth. Innovation and market expansion rely on strategic partnerships with foreign suppliers.

Value Chain Analysis

- Raw Material Sourcing

This stage involves sourcing high-quality ingredients such as fruit purees, jams, custards, chocolate, nuts, stabilizers, and emulsifiers that ensure stability during baking and storage.

Key Players: Avebe, MALA'S, Andros North America, Kandy, Herbstreith & Fox GmbH & Co. KG - Ingredient Processing & Formulation

Raw ingredients are processed into bakery-ready formulations, including fruit fillings, cream-based fillings, chocolate blends, and flavor-infused gels. Stabilizers and functional additives are incorporated to maintain texture, prevent syneresis, and ensure thermal stability during baking.

Key Players: Puratos Group, Dawn Foods, Fábrica de Mermeladas S.A. de C.V., Dr. Oetker GmbH - Product Manufacturing / Filling Production

The processed ingredients are converted into bake-stable fillings in various formats such as pastes, creams, or gels, tailored for use in cakes, pastries, muffins, and industrial bakery applications. Consistency, shelf life, and heat-resistance are ensured through controlled processing techniques.

Key Players: Puratos Group, Dawn Foods, Dr. Oetker GmbH, Barker Fruit Processors Ltd. - Packaging & Storage

Fillings are packaged in formats suitable for industrial or professional bakery use, including tubs, sachets, or bulk containers. Packaging ensures hygiene, preserves stability during transportation, and allows for easy integration into automated bakery processes.

Key Players: Dr. Oetker GmbH, Dawn Foods, Andros North America - Distribution & Integration with Bakeries / OEMs

Finished bake-stable fillings are distributed to industrial bakeries, patisseries, and large-scale food service operators. These fillings are used as core components in the production of ready-to-bake or fully baked bakery products.

Key Players: Puratos Group, Dawn Foods, Dr. Oetker GmbH, Kandy - End-Product Utilization & Consumer Market

Bakeries and food service providers use the fillings to create pies, pastries, cakes, muffins, and other baked goods. The focus is on consistent quality, taste, and texture, even after baking or freezing. Consumer feedback and market trends often feed back into formulation and product innovation.

Bake Stable Pastry Fillings Market Companies

- Dr. Oetker GmbH: Offers a wide range of high-quality bake-stable pastry fillings used in bakery, confectionery, and dessert applications, emphasizing taste consistency and performance during baking.

- Puratos Group: Develops innovative fruit and cream-based bake-stable fillings designed to enhance texture, flavor, and shelf life in pastries and baked goods.

- Avebe:Provides potato-based starch solutions that improve the stability and structure of pastry fillings during high-temperature baking processes.

- Mala's: Manufactures fruit-based bake-stable fillings and jams catering to bakery and confectionery industries with a focus on authentic fruit flavor and versatility.

- Dawn Foods: Supplies premium bake-stable fillings, including fruit and chocolate varieties, offering consistent performance and convenience for commercial bakeries.

- Herbstreith & Fox GmbH & Co. KG: Specializes in pectin and fruit fiber ingredients that enhance the texture, viscosity, and bake stability of fruit-based pastry fillings.

- Fábrica de Mermeladas S.A. de C.V.: Produces high-quality fruit jams and fillings suitable for baking, emphasizing natural ingredients and stable consistency.

- Andros North America: Provides professional-grade bake-stable fruit fillings known for natural taste and superior stability during baking processes.

- Kandy:Offers bake-stable pastry fillings and fruit preparations tailored for industrial and artisanal bakeries with a focus on flavor customization.

- Barker Fruit Processors Ltd.:Manufactures fruit-based bake-stable fillings that maintain flavor and texture integrity under high baking temperatures, serving both domestic and export bakery markets.

Recent Developments

- In February 2022, Dawn Foods exposed the cocoa Delicream, a new variety of cocoa fillings. With this opening, the corporation aimed to offer final bake and freeze-thaw stability with no water and hydrogenated fats substance.

- In September 2021, Puratos launched Puratos Classic, a line of highly condensed flavouring compounds. This opening addressed difficulties in fruit fillings in baked foods, particularly clogged depositors.

- In March 2021, Dawn Foods obtained JABEX, a high-quality fruit-based goods manufacturer. With this purchase, the firm intended to broaden its global food manufacturing powers and enhance its functionings and supply chain throughout Eastern and Central Europe.

- In January 2020, Puratos India introduced Tegral Satin Purple Velvet EF, Fruitfil Range, Carat Supercrem Nutolade, Tegral Red and Velvet Sponge Mix. This start aimed to meet the growing consumer demand for international food with a regional touch. In addition, this opening would also transform Chocolate, the Indian Bakery, and the Patisserie market.

Segments Covered in the Report

By Product

- Chocolate

- Fruits

- Nuts

- Others

By Distribution Channel

- Offline

- Online

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client