List of Contents

What is Automotive Retrofit Electric Vehicle Powertrain Market Size?

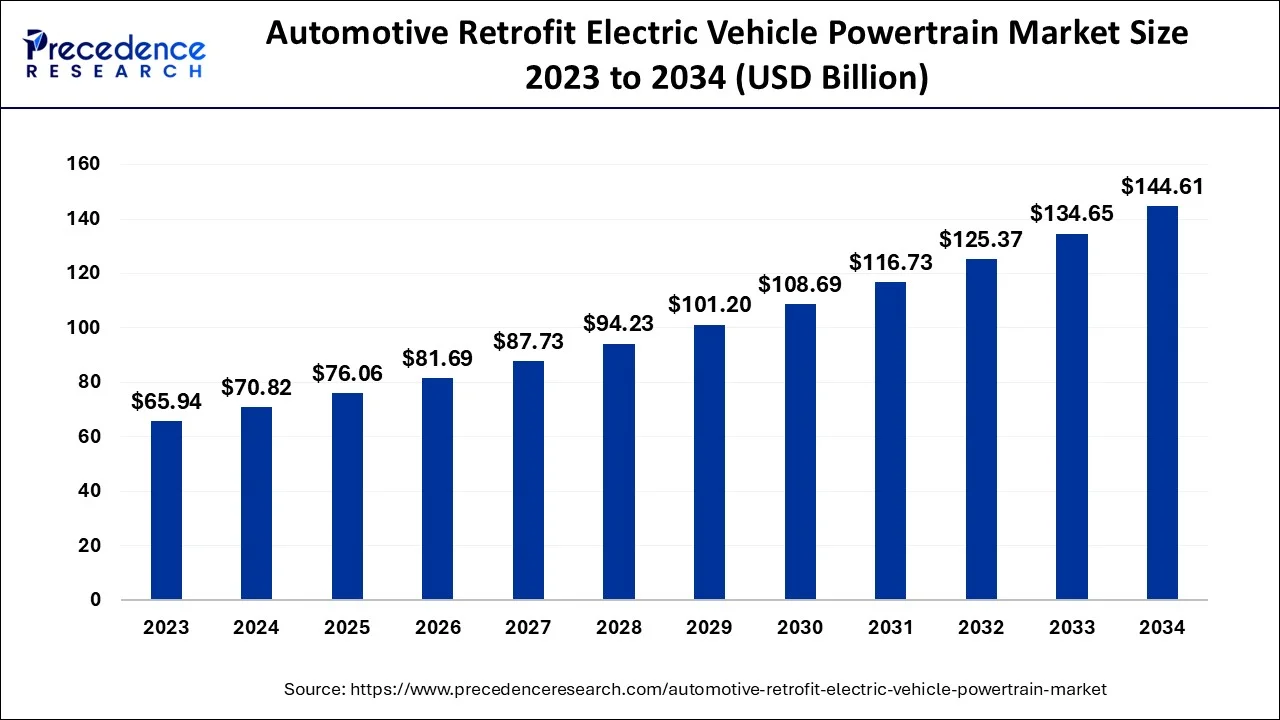

The global automotive retrofit electric vehicle powertrain market size is accounted for USD 7.06 billion in 2025 and is anticipated to reach around USD 144.61 billion by 2034, growing at a CAGR of 7.40% from 2025 to 2034.

Market Highlights

- By vehicle type, the commercial vehicle segment has dominated the market with 48% market share in 2024.

- The passenger vehicle segment growing at a CAGR of 7.35% from 2025 to 2034.

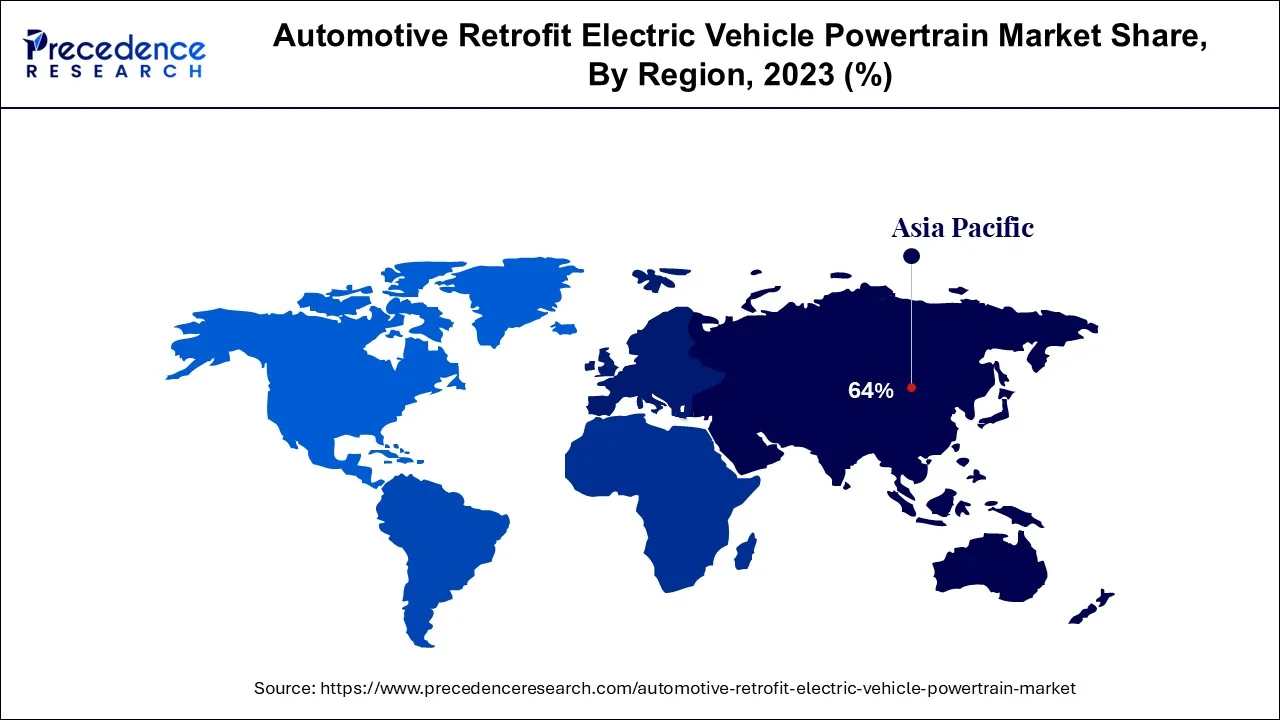

- The Asia Pacific has held market share of 64% in 2024.

- The Europe has held value shares of over 17% in 2024.

Automotive Retrofit Electric Vehicle Powertrain Market Growth Factors

The need for automotive powertrains is also being fuelled by the rising demand for vehicle electrification in the automotive sector and the rising sales of electric automobiles. Additionally, it is anticipated that the industry would expand more quickly due to the rising need for automatic transmissions and engine downsizing to increase vehicle fuel economy.

Market Outlook

- Industry Outlook: the industry is undergoing a structural transition toward integrated automation ecosystems. ASRS vendors are evolving into full-stack solution providers offering hardware, software analytics, control systems, remote diagnostics, and lifecycle services. Partnerships are emerging among ASRS manufacturers, WMS/WES software providers, robotics developers, and cloud-analytics platforms. Industry consolidation is rising as companies seek scale, proprietary technologies, and global installation capabilities.

- Major Investment Areas: the high density shuttle and cube-based systems for e-commerce and retail. The robotic item picking integration to achieve end-to-end automation. The AI-driven warehouse execution systems for real-time optimization in the greenfield mega distribution centers featuring deep automation stacks. Investors prioritize systems that deliver both throughput and flexibility, with emphasis on digital twin modelling, predictive maintenance, and robotics integration.

- Startup Shaping the Future: robot shuttle hybrids offering flexible movement in 3D cube grids, because of the modular micro-fulfilment ASRS for grocery, pharma, and convenient retail. In automated tote to person systems that biend ASRS with robotic picking. These startups are redefining speed-to-deploy, cost accessibility, and software intelligence in storage automation.

- Global Expansion:The Automated Storage & Retrieval System (ASRS) market is experiencing significant global expansion as businesses increasingly adopt efficient logistics solutions. North America leads in advanced ASRS technology adoption, driven by a booming e-commerce sector and the push for enhanced supply chain efficiency.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 7.06 Billion |

| Market Size in 2026 | USD 81.69 Billion |

| Market Size by 2034 | USD 144.61 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 7.40% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component Type, Vehicle Type, Electric Vehicle Type, and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

- Rise in sale of vehicles: One of the main factors driving the market for electric cars is the increase in global vehicle sales. The automotive retrofit electric vehicle powertrain market is expected to grow globally as a result of the emphasis that car manufacturers are placing on converting older automobiles to electric vehicles. The adoption of multiple emission-related norms and regulations by different countries throughout the world is projected to increase demand for electric vehicle powertrains for retrofitted automobiles. The market for automotive retrofit electric vehicles is anticipated to grow due to the rise in demand for automatic transmissions in vehicles to increase driving comfort because retrofit electric vehicles don't need gears. Electric cars are anticipated to be a practical choice to realise the major nations' focus on the creation of pollution-free smart cities.

- soaring fuel prices and increasing sales of EV - Continuous fuel price increases and ongoing environmental concerns have increased customers' preference for electric mobility alternatives, especially in industrialised nations. As a result, automakers are concentrating on creating e-powertrain solutions that are small, light, and appropriate for daily commuting. The market for electric vehicle powertrains is also anticipated to be driven by alluring government policies and support in the form of grants and subsidies, encouragement for domestic manufacture, widespread use of electric cars, and other non-financial incentives.

Key Market Challenges

- Impact of COVID-19: The COVID-19 pandemic altered the nature of business in 2020, and it is believed that it would have an impact on the general business environment in the next years. Lockdowns implemented globally to stop the virus's spread have caused supply chain delays and the temporary shutdown of several manufacturing sites. Shipments were delayed as a result, and output levels fell sharply. The automotive powertrain business was similarly impacted by the decline in sales of cars and trucks. Due to reported manufacturing delays and delays in foreign shipments, suppliers of raw materials to manufacturers of automobile powertrains continued to have problems in the second half of 2020.

Key Market Opportunities

- The government has imposed strict regulations on vehicle emissions - As particulate matter emissions from cars rise, the quality of the air is deteriorating, which has a bad impact on health of living beings as well as the environment. Due to which, governments all over the globe have mandated strictly emission standards for car makers. As a result, manufacturers have been forced to invest more in R&D for electric cars in order to provide consumers an affordable alternative, which has spurred the expansion. The pursuit of practical answers for the engine architecture of electric vehicles is motivated by this aspect.

- Government initiatives - Throughout the projected period, several government incentives for electric cars are anticipated to boost demand. Various government incentives have enabled the acceptance of electric cars globally. Some of these include free transportation to the main commercial districts of important urban regions, waiver of enrollment fees and tolls, free street use due to specific street pricing and toll-free zones, and sponsorships and payback offered during the purchase of electric cars. Many business owners need to switch to electric vehicles in order to take advantage of these benefits. Retrofitting is one of the really clever approaches for people to switch to electric movement transportation and take advantage of these benefits. Through the projected period, these factors are anticipated to drive the market.

Automated Storage and Retireval Systems: The Future of Fast, Frictionless Warehousing

The Automated Storage & Retrieval System (ASRS) market is transforming the global logistics backbone. These systems ranging from high-bay warehouses and robotic shuttles to vertical lift modules and autonomous cranes enable rapid, accurate, and fully automated movement of goods in distribution centers, manufacturing plants, cold storage, and e-commerce facilities. As global supply chains accelerate and labour availability tightens, ASRS has become essential for high-density storage, continuous operations, error-free fulfilment, and space optimization.

Today's ASRS does more than store and move goods it forms the intelligent nerve-center of modern digital warehousing.The Automated Storage & Retrieval System (ASRS) market is transforming the global logistics backbone. These systems ranging from high-bay warehouses and robotic shuttles to vertical lift modules and autonomous cranes enable rapid, accurate, and fully automated movement of goods in distribution centers, manufacturing plants, cold storage, and e-commerce facilities. As global supply chains accelerate and labor availability tightens, ASRS has become essential for high-density storage, continuous operations, error-free fulfilment, and space optimization. Today's ASRS does more than store and move goods; it forms the intelligent nerve-center of modern digital warehousing.

Segment Insights

Component Type Insights

For this technology, the transmission market sector has the biggest market share. Most electric cars come with a single speed gearbox. But further research and development has been done to examine the economic viability of multiple-speed transmissions, such the Porsche Taycan. Leading producers of electric car transmissions are creating load shifting capabilities and multispeed transmission sailing operations. These elements are anticipated to support market expansion in this niche.

Over the projection period, the sector for power distribution modules (PDMs) is anticipated to develop at the quickest rate. The market expansion in this sector is being driven by the increased use of electric functionalities in EVs and the cost savings related with PDM. In this market, the electric motor sector is anticipated to have consistent expansion. Improved motor design was necessary due to the increased thermal limitations, which further reduced the cost of additional materials for the electric motor. This reason also contributes to the expansion of electric drivetrain motors. With producers developing new product lines to hasten integration in commercial vehicles, the converter category is predicted to have stable expansion in this market. Given that manufacturers want to outfit cars with an integrated unite that incorporates inverter and converter functionalities, the inverter category is anticipated to have modest development in this market.

Vehicle Type Insights

Over the course of the projected period, the passenger vehicle category is anticipated to rule the market. The market for Electric Powertrains in this sector is expanding due to rising consumer demand for automobiles for daily transportation and the quick uptake of electric cars, particularly in emerging nations. In this industry, it is projected that the bus and coach segment would continue to rise steadily. The development of vehicle-to-grid services, improved grid solutions, and increased acceptance of electric buses by transit agencies, especially in China and India, are projected to fuel the growth of the EV powertrain market in this sector

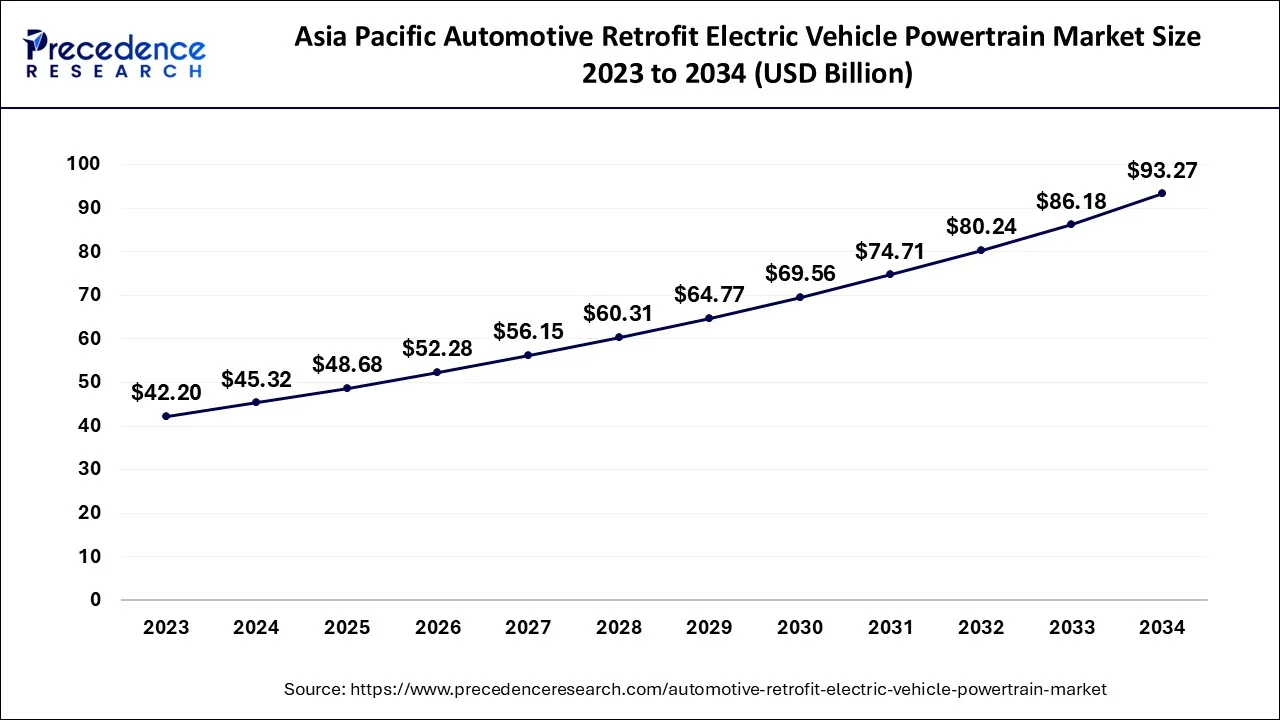

Asia Pacific Automotive Retrofit Electric Vehicle Powertrain Market Size and Growth 2025 to 2034

The Asia Pacific automotive retrofit electric vehicle powertrain market size is evaluated at USD 48.68 billion in 2025 and is predicted to be worth around USD 93.27 billion by 2034, rising at a CAGR of 7.48% from 2025 to 2034.

The Asia Pacific region is anticipated to increase significantly throughout the projection period. The main reason for the high market penetration is a number of legislative initiatives that encourage the purchase of EVs, such as EV sales quotas, fuel economy objectives, and benefits for EVs in the assignment of licence plates in nations like China. The market in this area is being driven by the adoption of severe emission laws like BS-VI in China and India.

Partnerships amongst top companies to create a charging infrastructure are also promoting market expansion in this area. For instance, Didi Chuxing from China and BP, the world's largest oil company, have partnered to build EV charging stations in China. Lithium deposits in China are encouraging further investment in the battery industry. Tesla also introduced the Model 3 with a significant price decrease in South Korea as a result of favourable government measures. These elements are most likely to contribute to APAC having the largest market share.

Over the course of the projected period, Europe is anticipated to dominate the market. The primary force in this area is the rule that every auto manufacturer must abide by regarding carbon emissions for newly registered automobiles. In addition, adoption of e-mobility and resistance to transportation powered by internal combustion engines are growing. These elements are promoting market expansion in this area.

In this market, North America is anticipated to have consistent growth. However, in some locations, particularly coastal areas, a more considerable market share of electric vehicle powertrains is projected, which is assisting the expansion in this field. Typical US consumers drive longer distances and prefer bigger cars.

How Middle East and Africa Navigating the Future of Automated Storage?

The Automated Storage and Retrieval System (ASRS) market is gradually gaining traction in the Middle East and Africa (MEA), fueled by increasing demand for efficient logistics solutions and the modernisation of supply chains. The roadmap for ASRS adoption in this region is shaped by diverse economic conditions, infrastructural developments, and technological advancements. However, the country faces challenges such as inconsistent power supply and infrastructure limitations, which can hinder widespread automation adoption. Investment in logistics and technology infrastructure will be crucial for ASRS growth.

South Africa in Automated Storage and Retrieval System Market

As the most developed economy in Africa, South Africa is witnessing a gradual shift towards automation in warehousing and supply chain processes. The retail sector is particularly focused on adopting ASRS technologies to improve inventory management and reduce operational costs. Challenges such as infrastructure deficits and regulatory hurdles persist, but potential growth remains strong.

| REGION | STRENGTHS | KEY SECTOR | NOTABLE CHARACTERISTICS |

| UAE | Advanced logistics infrastructure | Cold chain retail, reexport logistics | Heavy investment in high density ASRS for ports. |

| SAUDI ARABIA | Large retail and food distribution base | FMCG, industrial warehousing | Warehousing mordenization aligned with economic diversification. |

| QATAR | food security and cold-chain focus | Pharme grocery | niche but high-quality ASRS adoption. |

| CHINA | Cost-effective manufacturing scale | e-commerce manufacturing | High deployment of shuttle and cube systems |

Market Value Chain Analysis

- Raw Material Sourcing: Sourcing emphasizes reliability, long service life, and precision manufacturing, as ASRS performance heavily depends on structural stability and electronic accuracy.

Key players: Daifuku Co., Ltd, Dematic (KION Group AG), SSI Schaefer Group and Kardex Group - Component Fabrication:Fabricating components for an Automated Storage and Retrieval System (ASRS) involves producing mechanical, electronic, and software parts that come together as a complete system. Mechanical parts include storage racks, storage/retrieval devices such as cranes or shuttles, and transport mechanisms like conveyors or AGVs.

Key players: Daifuku and SSI SCHAEFER

Automotive Retrofit Electric Vehicle Powertrain Market Top Companies

- Daifuku Co. Ltd. (Japan): A major provider of material handling systems, including conveying, transport, storage, sorting, and picking systems.

- SSI Schaefer Group (Germany): A leading supplier of automated storage and retrieval systems and other logistics solutions.

- Murata Machinery (Japan): A company involved in the manufacturing of automated machinery, including material handling systems.

- Knapp AG (Austria): An Austrian company specializing in automated warehousing and logistics solutions.

- Mecalux SA (Spain): A Spanish company that provides storage solutions and automated systems.

- Vanderlande Industries (Netherlands): A Dutch company known for its automated material handling solutions for warehouses and airports.

- System Logistics Corporation (Italy): An Italian company that designs and manufactures automated logistics systems.

- Bastian Solutions (US): A US-based company that provides a range of automated material handling and warehouse automation solutions.

Recent Developments

- In July 2021, German carmaker Mercedes Benz announced that it will purchase YASA, a provider of next-generation electric propulsion technology. The business offers the automobile sector solutions for electric and hybrid powertrains. Yasa will continue to function as a Mercedes Benz wholly-owned subsidiary.

- In July 2021, LG Electronics and Magna International establish a joint venture to develop electric vehicles (EVs). The transaction contract has been formally signed by both businesses. The new business will be situated in Incheon, South Korea and go by the name LG Magna e-powertrain. It will initially employ 1000 people.

- In July 2021, Hyliion, a supplier of electric power trains, and FEV, a specialist in powertrain and automotive development for software and hardware, signed a long-term deal. For class-8 tractor-trailer applications, the alliance is anticipated to help the architecture, manufacturing, integration, and manufacturing validation of its Electric Range Extender (ERE).

- A new powertrain division was launched by the electric class 5 to class 8 commercial vehicle manufacturer Xos Inc. in June 2021. With other OEMs in the off-road, commercial, and industrial industries, the new division will provide Xos powertrain technology as well as design and implementation know-how. The business said that it will continue to create commercial vehicles based on its own X-Pack and X platform through its expanding OEM segment, closely collaborating with its new and loyal clients.

Segments Covered in the Report

By Component Type

- Inclusive Conversion Kit

- Electric Motor

- Battery

- Controller

- Charger

- Others (Axle, Converter, etc.)

By Vehicle Type

- Two Wheelers

- Passenger Vehicle (Hatchback, Sedan and Utility Vehicle)

- Commercial Vehicle (Light Commercial Vehicle and Heavy Commercial Vehicle)

By Electric Vehicle Type

- All Electric Vehicle Battery

- Plug-in Hybrid Vehicle

- Hybrid Vehicle

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client