List of Contents

What is Atherectomy Device Market Size?

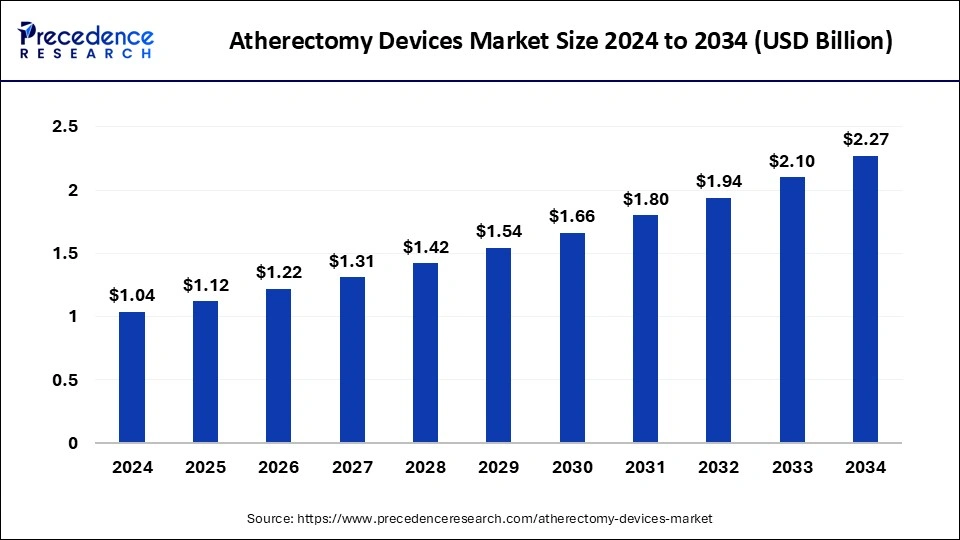

The global atherectomy devices market size was calculated at USD 1.12 billion in 2025 and is predicted to increase from USD 1.22 billion in 2026 to approximately USD 2.27 billion by 2034, expanding at a CAGR of 8.12% from 2025 to 2034. The market is driven by atherectomy device innovations that include technological advancements, such as miniaturization and improved imaging modalities, enhancing precision and efficacy in plaque removal.

Market Highlights

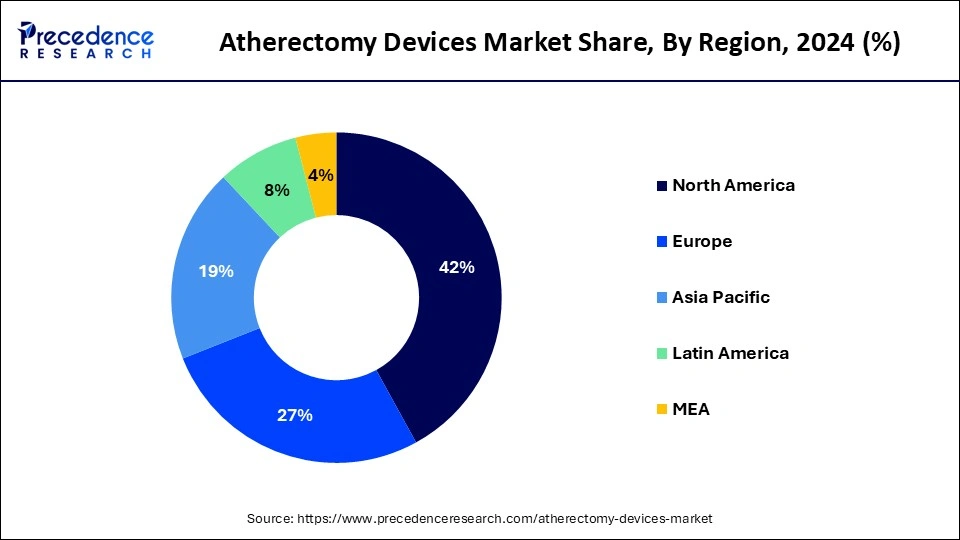

- North America led the market with the biggest market share of 42% in 2024.

- Asia Pacific is projected to expand at the fastest rate during the forecast period of 2025-2034.

- By device type, the drug-coated balloons (DCBs) segment held the largest share of the market in 2024.

- By device type, the intravascular ultrasound (IVUS) catheter segment is expected to show the fastest growth.

- By application type, the peripheral artery disease segment held the dominating share of the market in 2024.

- By application type, the coronary artery disease segment represents another highly influential segment for the forecast period.

- By end-user, the cardiac catheterization labs segment held the dominating share of the market in 2024.

- By end-user, the interventional radiology department segment is expected to witness a significant rate of expansion during the forecast period.

Which are the Emerging Types of Atherectomy Devices?

Atherectomy devices are specialized medical instruments used to remove plaque buildup from arteries, particularly in the treatment of atherosclerosis. Atherosclerosis is a condition where plaque, made up of cholesterol, fat, calcium, and other substances, accumulates on the inner walls of arteries, leading to narrowing and hardening of the arteries. Atherectomy procedures are minimally invasive alternatives to traditional surgical methods, such as bypass surgery, and are often performed to restore blood flow in arteries affected by atherosclerosis.

There are several types of devices, each designed for specific applications and preferences of clinicians. Rotational devices use a rotating burr or blade to shave away plaque from the artery walls, while directional devices employ a cutting mechanism to remove plaque in a controlled manner. Laser atherectomy devices use laser energy to vaporize plaque, and orbital atherectomy devices utilize a unique orbital mechanism to sand down plaque. Each type of device has its advantages and may be chosen based on factors such as the location and severity of plaque buildup and the patient's overall health condition.

Atherectomy Devices Market Growth Factors

A therectomy devices have benefited from continuous technological advancements, leading to the development of more efficient and precise tools for plaque removal in arteries. Innovations such as improved rotational mechanisms, enhanced visualization capabilities, and miniaturization of devices have contributed to greater efficacy and safety in atherectomy procedures. These advancements enable physicians to navigate through complex arterial structures with increased precision, facilitating thorough plaque removal while minimizing damage to surrounding tissues.

The growth of the atherectomy devices market is bolstered by ongoing clinical research and evidence supporting their effectiveness and safety in treating arterial disease. Clinical trials and studies provide valuable insights into the outcomes and benefits of atherectomy procedures, helping to establish their role in the management of various arterial conditions. As more evidence emerges demonstrating favorable patient outcomes and reduced procedural complications, confidence in the use of atherectomy devices among healthcare providers grows, driving further adoption and utilization.

Comprehensive physician training and education programs play a crucial role in the adoption and utilization of atherectomy devices. Manufacturers invest in training initiatives to educate healthcare professionals on the proper use of atherectomy systems, procedural techniques, and patient selection criteria. By equipping physicians with the necessary knowledge and skills, these training programs empower them to confidently incorporate atherectomy into their clinical practice, expanding access to this minimally invasive treatment option for patients with arterial disease.

The atherectomy devices market continues to evolve with expanded indications and applications, allowing for their utilization in a broader range of clinical scenarios. Manufacturers continually seek regulatory approvals for new indications and expand the capabilities of existing devices to address evolving clinical needs. This expansion of indications, coupled with advancements in device design and technology, enhances the versatility and effectiveness of atherectomy procedures, positioning them as a valuable treatment option for an increasing number of patients with arterial disease.

Atherectomy Devices Market Outlook:

- Global Expansion: Along with the growing geriatric population, the globe is facing a rise in cardiovascular and peripheral artery diseases, with an escalating preference for minimally invasive procedures.

- Major Investors: Abbott, Boston Scientific, Medtronic, and Koninklijke Philips N.V. are increasingly investing in research and development and strategic acquisitions.

- Startup Ecosystem: Avinger, Inc., a public company that initially started as a startup, with its image-guided atherectomy technology.

Atherectomy Devices Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.12 Billion |

| Market Size in 2026 | USD 1.22 Billion |

| Market Size by 2034 | USD 2.27 Million |

| Growth Rate from 2025 to 2034 | CAGR of 8.12% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Devices Type, Application, and End-user, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Technological innovation

Advancements in medical technology have revolutionized the atherectomy devices market. Miniaturization, improved imaging modalities, and the development of novel materials have enabled the creation of increasingly sophisticated atherectomy devices. For example, the integration of advanced imaging techniques such as intravascular ultrasound (IVUS) and optical coherence tomography (OCT) allows for real-time visualization of arterial structures, guiding precise interventions.

The miniaturization of devices has facilitated the use of minimally invasive procedures, reducing patient discomfort and recovery time. Continued innovation in device design, including the incorporation of robotics and artificial intelligence, holds promise for further enhancing the efficacy and safety of the products and services of the atherectomy devices market.

Deeper understanding of arterial biomechanics

Atherosclerosis is not merely a passive buildup of plaque within arteries but a dynamic process influenced by arterial biomechanics. Research into the mechanical forces acting on arterial walls, such as shear stress and cyclic strain, has revealed their profound effects on endothelial function, plaque development, and vulnerability. This deeper understanding has informed the design of atherosclerosis devices that not only remove plaque but also modulate biomechanical factors to promote arterial healing and stability.

Devices capable of delivering localized drug therapies or modulating blood flow patterns can help prevent restenosis and thrombosis. By integrating biomechanical principles into device design and treatment strategies, clinicians can tailor interventions to address the specific biomechanical challenges posed by individual patients' arterial lesions, leading to improved outcomes in atherosclerosis management.

- In April 2022, AngioDynamics unveiled the Auryon Atherectomy System, a groundbreaking laser atherectomy system designed to treat any lesion type, length, and location with minimal impact on vessel walls. This innovative technology marks a significant advancement in atherectomy procedures, offering clinicians greater flexibility and precision in treating atherosclerosis.

Restraint

Regulatory hurdles in navigating complex approval processes and safety standards for atherosclerosis devices

Navigating the complex landscape of regulatory approvals poses a significant restraint in the development and deployment of atherosclerosis devices. Manufacturers must adhere to stringent safety standards and demonstrate the efficacy of their devices through rigorous clinical trials, adding time and cost to the development process. Regulatory agencies, such as the FDA in the United States and the European Medicines Agency (EMA) in Europe, require comprehensive data on device performance, including safety profiles and long-term outcomes, before granting market approval.

Additionally, evolving regulatory requirements and guidelines further compound the challenge, necessitating continuous adaptation and compliance. Delays in regulatory approvals or failure to meet stringent criteria can significantly impede the availability of new atherosclerosis devices, limiting options for patients and clinicians and hindering advancements in treatment modalities for arterial disease.

Opportunities

Emerging therapeutic modalities on expanding treatment options for atherosclerosis management

One significant opportunity in the atherectomy devices market lies in the exploration and development of emerging therapeutic modalities. Beyond traditional atherectomy procedures, researchers are investigating innovative approaches such as gene therapy, targeted drug delivery, and immunomodulation to address the underlying mechanisms of arterial disease.

Gene therapy holds promise for delivering therapeutic genes directly to affected arteries, promoting plaque stabilization and regression. Similarly, targeted drug delivery systems enable precise delivery of therapeutic agents to diseased arterial segments, minimizing systemic side effects and enhancing efficacy. Furthermore, immunomodulatory strategies aim to modulate the immune response within arterial walls, reducing inflammation and promoting plaque stability. By leveraging these emerging therapeutic modalities, atherosclerosis devices can offer more tailored and effective treatments, potentially improving outcomes for patients with arterial disease.

- In January 2024, Researchers at Ludwig Maximilian University (LMU) Christian Weber and Yvonne Döring unveiled a novel signaling pathway implicated in inflammatory cardiovascular diseases, shedding new light on the pathogenesis of atherosclerosis.

Integration of digital health technologies on enhancing monitoring and personalized management of atherosclerosis

Another critical aspect of the atherectomy devices market is patient engagement and self-management, which can be enhanced through interactive educational resources, real-time feedback, and support networks, empowering individuals to take an active role in managing their arterial health. Overall, the integration of digital health technologies into atherosclerosis devices holds promise for improving patient outcomes, enhancing clinical decision-making, and reducing healthcare costs.

Another critical aspect of the atherectomy devices market is patient engagement, and self-management that can be enhanced through interactive educational resources, real-time feedback, and support networks, empowering individuals to take an active role in managing their arterial health. Overall, the integration of digital health technologies into atherosclerosis devices holds promise for improving patient outcomes, enhancing clinical decision-making, and reducing healthcare costs.

- In November 2023, the Centro Nacional de Investigaciones Cardiovasculares (CNIC), in collaboration with Santander Bank, conducted the PESA-CNIC-Santander Study, focusing on early subclinical atherosclerosis progression. The comprehensive study underscores the importance of aggressive risk management from a young age to prevent or reverse the development of atherosclerosis, highlighting the critical role of proactive healthcare interventions.

Segment Insights

Devices Type Insights

The drug-coated balloons (DCBs) segment dominated the atherectomy devices market with the largest share in 2024.DCBs Catheters. DCBs have gained popularity due to their ability to deliver anti-proliferative drugs directly to the arterial wall during balloon angioplasty, reducing restenosis rates and the need for additional stents.

The intravascular ultrasound (IVUS) catheter segment is expected to show the fastest growth in the atherectomy devices market during the forecast period. IVUS catheters provide real-time, high-resolution imaging of the arterial lumen and vessel wall, aiding in lesion assessment, stent sizing, and optimization of stent deployment. Both technologies have contributed to improved procedural outcomes, reduced complication rates, and enhanced patient care in the management of atherosclerotic disease.

Application Insights

The peripheral artery disease (PAD) treatment devices segment dominated the atherectomy devices market in 2024. Recent advancements in PAD treatment devices have focused on enhancing efficacy and durability while minimizing invasiveness. Technologies such as drug-coated balloons and drug-eluting stents have shown promising results in reducing restenosis rates and improving the long-term patency of treated arteries. Additionally, the development of atherectomy devices with improved navigation and tissue removal capabilities has expanded treatment options for complex PAD lesions, particularly in cases where traditional angioplasty or stenting may not be feasible.

The coronary artery disease (CAD) intervention device segment shows notable growth in the atherectomy devices market during the forecast period. In the realm of CAD intervention devices, there has been a noteworthy emphasis on enhancing precision and safety during percutaneous coronary interventions (PCIs). Innovations such as bioresorbable vascular scaffolds (BVS) and drug-eluting stents with biocompatible coatings aim to reduce the risk of late stent thrombosis and improve vascular healing. Furthermore, the integration of intravascular imaging technologies, such as optical coherence tomography (OCT) and intravascular ultrasound (IVUS), has enabled more accurate lesion assessment and optimized stent placement, leading to improved procedural outcomes and long-term clinical success rates.

End User Insights

The catheterization labs and interventional radiology departments segment dominated the atherectomy devices market in 2024. cardiac catheterization labs and interventional radiology departments have seen increased usage of atherosclerosis devices. Cardiac catheterization labs specialize in diagnosing and treating cardiovascular conditions, including atherosclerosis, through minimally invasive procedures.

The interventional radiology department segment is expected to witness a significant rate of expansion during the forecast period. Interventional radiology departments offer expertise in image-guided interventions, making them well-suited for atherosclerosis device placement and monitoring. Both settings provide advanced equipment and skilled personnel, facilitating the precise placement and monitoring of atherosclerosis devices to manage arterial disease effectively. This trend reflects the growing importance of minimally invasive techniques and interdisciplinary collaboration in the treatment of atherosclerosis.

Regional Insights

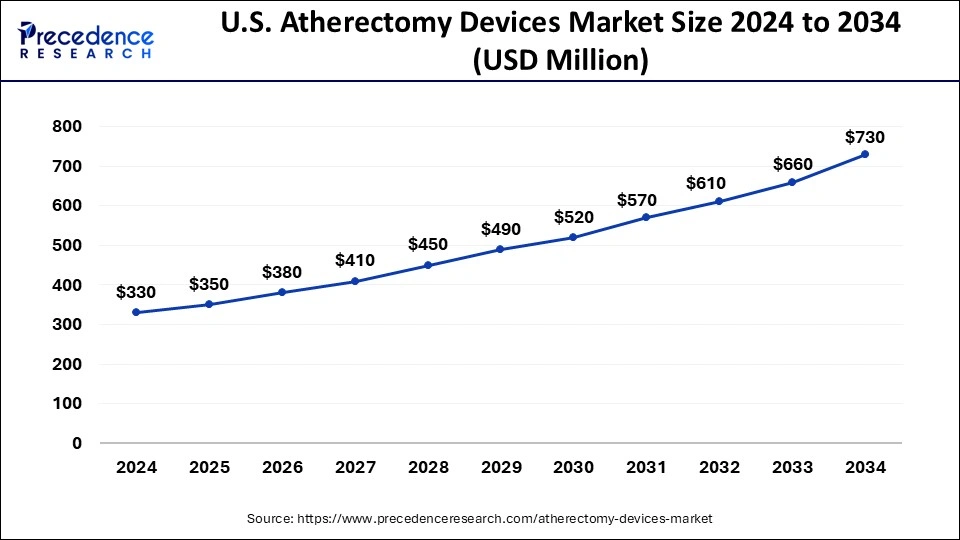

U.S. Atherectomy Devices Market Size and Growth 2025 to 2034

The U.S. atherectomy devices market size is exhibited at USD 350 million in 2025 and is projected to be worth around USD 730 million by 2034, growing at a CAGR of 8.26%.

What Made North America Dominant in the Atherectomy Devices Market in 2024?

North America led the global market with the highest market share of 42% in 2024. Atherectomy devices have seen significant utilization and dominance in North America, particularly in the United States of America (USA) and Canada. The USA boasts advanced healthcare infrastructure and extensive research and development capabilities, driving the adoption of atherectomy devices for the treatment of atherosclerosis. Similarly, Canada benefits from a well-established healthcare system and a high prevalence of cardiovascular diseases, contributing to the widespread use of these devices.

Expansion of Healthcare Solutions is Propelling the Asia Pacific

Asia-Pacific is expected to witness growth at a significant rate in the atherectomy devices market during the forecast period of 2025-2034. Asia Pacific region is experiencing rapid growth and emergence as a key market for atherectomy devices. Countries like China, India, Japan, and South Korea are witnessing increasing adoption of these devices due to rising healthcare awareness, improving access to advanced medical technologies, and a growing burden of cardiovascular diseases. As healthcare infrastructure continues to develop and awareness of minimally invasive treatment options expands, the Asia Pacific region is expected to play a significant role in the global market for atherectomy devices.

Phenomenal Recent Developments: U.S. Market Analysis

The U.S. market has been blooming in innovative technologies in the atherectomy devices, such as the Pantheris system received FDA approval, which utilises optical coherence tomography (OCT) to support plaque removal with a side cutter and apposition balloon. As well as the US is also implementing the Revolution Peripheral Atherectomy System with the contribution of an Archimedes screw to withdraw particles during the procedure, minimising the risk of distal embolisation.

Widespread Use of IVUS and OCT: Japan Market Analysis

A rigorous utilization of Intravascular Ultrasound (IVUS) and Optical Coherence Tomography (OCT) by numerous Japanese operators to find accurate plaque morphology (e.g., calcification thickness and distribution). Besides this, the recent shift in the Japanese distribution of the Diamondback 360° Coronary Orbital Atherectomy System (OAS) to Abbott Medical Japan LLC is also assisting in the further extensive growth.

Immersive AI-Driven Navigation & Hybrid Devices Support Europe

Europe is experiencing a lucrative growth in the atherectomy devices market, due to the rising steps into AI-powered navigation & hybrid devices. Furthermore, Medtronic launched AI-enabled navigation for image-guided peripheral artery atherectomy procedures in Europe, and Abbott boosted its portfolio with hybrid atherectomy devices that integrate imaging and aspiration capabilities.

Unveiling of New Laser Technology: UK Market Analysis

In late 2025, the University Hospitals Plymouth NHS Trust introduced the novel Auryon laser catheter from AngioDynamics. This system is widely employed in the treatment of different plaque morphologies, such as in-stent restenosis and blood clots (thrombus), and is mainly valuable for high-risk patients for whom conventional bypass surgery is not suitable.

Atherectomy Devices Market: Value Chain Analysis

- R&D

The market covers discovery and concept, preclinical research and prototype development, clinical trials, regulatory review and approval, and post-market monitoring of these devices.

Key Players: Boston Scientific, Medtronic, Koninklijke Philips N.V., etc. - Distribution to Hospitals, Pharmacies

These advanced devices are mainly distributed from manufacturers to hospitals and specialized surgical centers, either directly or through medical device distributors and wholesalers.

Key Players: Avinger, Inc., Abbott Laboratories, Terumo Corporation, etc. - Patient Support & Services

This mainly explores entire patient education materials, reimbursement assistance programs, and resources for physicians that contribute to positive patient outcomes.

Key Players: BD, Medtronic, etc.

Key Companies and their Offerings in the Atherectomy Devices Market

|

Company |

Strategic Move |

Offering/Strength |

Impact on Market Growth |

|

Abbott Laboratories |

Acquired Cardiovascular Systems, Inc. |

Rotational/orbital atherectomy systems |

Strengthens vascular portfolio and boosts market share |

|

Boston Scientific |

Launched next-gen Jetstream Elite system |

Rotational atherectomy with aspiration |

Drives innovation and adoption, capturing major demand |

|

BD (Becton, Dickinson) |

Focus on catheter and guidewire platforms |

Rotational atherectomy device components |

Enables modular growth and accessibility in procedures |

|

Cardinal Health Inc. |

Distributes vascular interventional products |

Logistics and supply for atherectomy systems |

Helps scale device availability and procedural volume |

|

Koninklijke Philips N.V. |

Acquired Vesper Medical to expand vascular range |

Laser atherectomy catheters and imaging-guided therapy |

Enhances precision treatment and supports hybrid OR growth |

Recent Developments

- In October 2023, Cardio Flow, Inc., announced U.S. Food and Drug Administration (FDA) 510(k) clearance for its FreedomFlow Orbital Atherectomy Peripheral Platform.

- In September 2023, Avinger Inc., a commercial-stage medical device company, announced the full commercial launch of its Tigereye ST next-generation image-guided chronic total occlusion (CTO) crossing system.

Segments Covered in the Report

By Devices Type

- Atherectomy Devices

- Angioplasty Balloon Catheters

- Stents (Bare-Metal, Drug-Eluting, Bioresorbable)

- Intravascular Ultrasound (IVUS) Catheters

- Optical Coherence Tomography (OCT) Catheters

- Drug-Coated Balloons

- Embolic Protection Devices

- Thrombectomy Devices

- Aortic Stent Grafts

- Endovascular Grafts

- Laser Atherectomy Devices

- Orbital Atherectomy Systems

- Rotational Atherectomy Devices

- Directional Atherectomy Devices

- Chronic Total Occlusion (CTO) Devices

By Application

- Peripheral Artery Disease (PAD) Treatment Devices

- Coronary Artery Disease (CAD) Intervention Devices

- Carotid Artery Disease Intervention Devices

- Renal Artery Disease Intervention Devices

- Aortic Atherosclerosis Intervention Devices

By End-user

- Cardiac Catheterization Labs

- Interventional Radiology Departments

- Vascular Surgery Centers

- Cardiology Clinics

- Academic Research Institutions

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client