List of Contents

What is the Animal Feed Antioxidants Market Size?

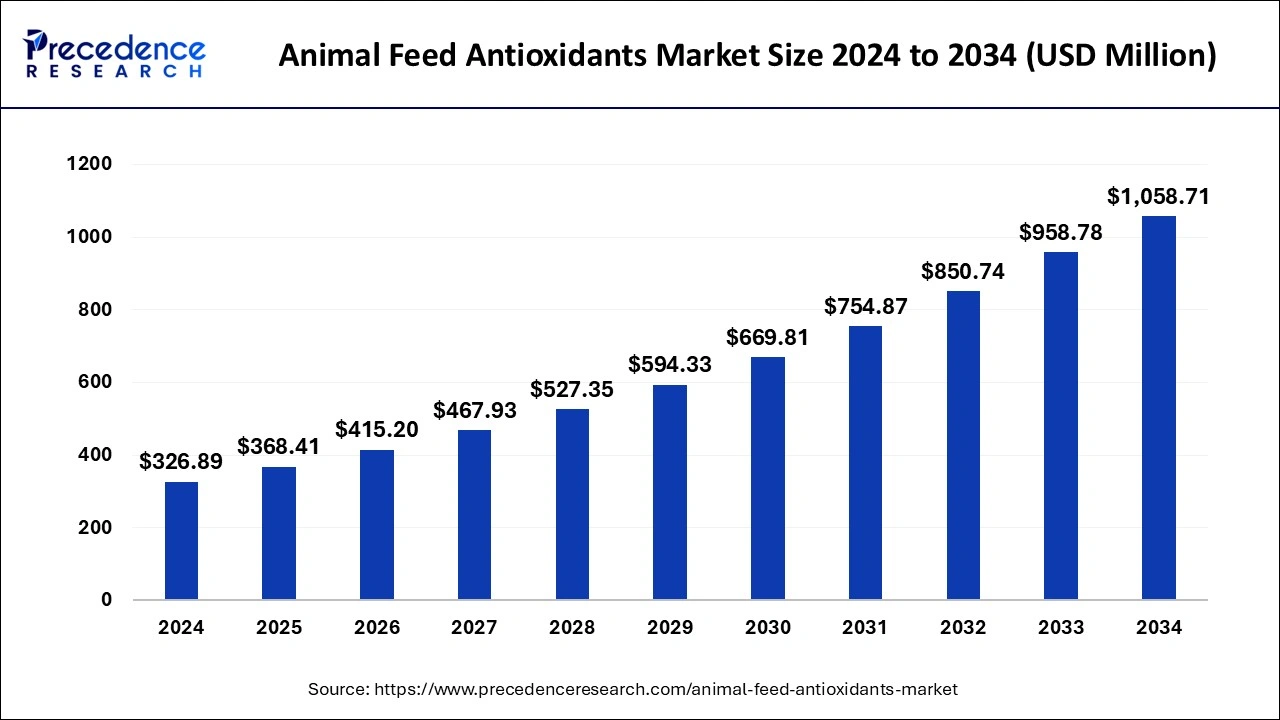

The global animal feed antioxidants market size is valued at USD 368.41 million in 2025 and is predicted to increase from USD 415.20 million in 2026 to approximately USD 1,058.71 million by 2034, expanding at a CAGR of 12.47% from 2025 to 2034. Increasing consumer awareness about the benefits of protein-rich products is a key factor driving market growth. Moreover, growing concern about animal health and feed safety is expected to boost the market growth in the coming years.

Animal Feed Antioxidants Market Key Takeaways

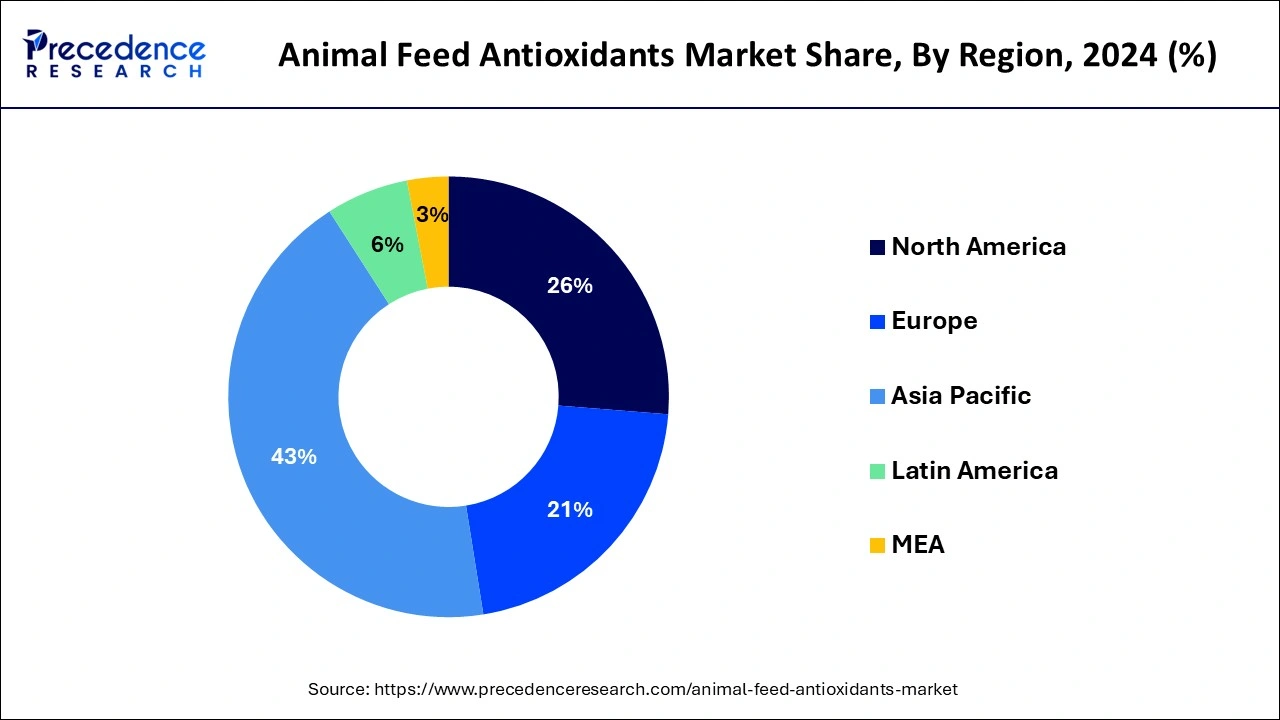

- The Asia Pacific region has dominated with a revenue share of 43% in 2024.

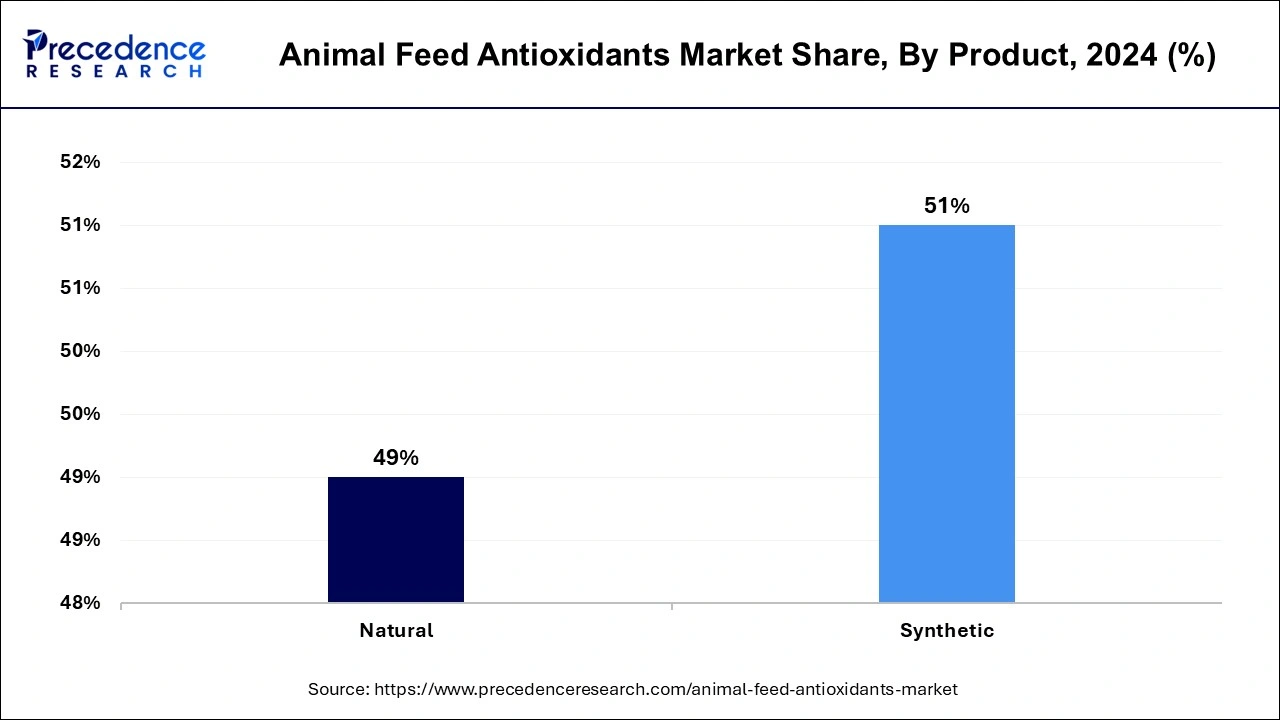

- By product, the synthetic segment has accounted revenue share of around 61% in 2024.

- The natural antioxidants segment is growing at a CAGR of 7.9% over the forecast period 2025-2034.

- By livestock, the poultry segment has held the highest revenue share of over 42% in 2024.

- The poultry and cattle dairy segment is expected to grow at a CAGR of 8.1% between 2025 to 2034.

How does AI impact the Animal Feed Antioxidants Market?

AI helps manufacturers create accurate feed formulations with the right amounts of antioxidants and nutrition. Integrating AI technologies in the production processes enhances the overall production efficiency and nutritional levels in final products. Furthermore, AI and ML algorithms analyze vast amounts of data related to animal health, enabling manufacturers to develop personalized feeds.

What are animal feed antioxidants?

Antioxidants for animal feed had a sizably large market in 2024, and it is anticipated that revenue will grow at a consistent CAGR during the projection period. Demand for premium feed is rising, feed production methods are getting better, and meat products are becoming more uniform, which are the main drivers influencing market revenue growth. One of the key elements driving an increase in demand for animal feed antioxidants is a growing concern about animal health and feed safety. Animal performance suffers as a result of oxidized feeds' lack of nutrients, which can cause several health problems. The feed's shelf life will be increased by adding antioxidants, protecting the feed's nutritional integrity. The inherent qualities of animal feed are impacted by several chemical changes that take place when it is being stored. The feed's antioxidant content is utilized to extend the feed's shelf life by minimizing lipid oxidation-related degradation. Antioxidants in the feed prevent autoxidation or hydrolysis from causing an oxidative reaction. As livestock farmers try to reduce feed costs to cut costs and maintain profitability, antioxidants have grown to be quite significant. The majority of antioxidants are synthesized and extracted naturally.

Trends in the Animal Antioxidants Market

Increasing demand for aqua-feed antioxidants is trending in the market due to their ability to boost farm fish immunity to an optimum level. Fish like tilapia, salmon, and shrimp benefited most from these feeds. With the usage of antioxidant feeds, the Food and Agriculture Organization ensures significant growth in the feed antioxidants should occur to expand itself in the global market.

Another notable trend is that, instead of synthetic additive animal feed, many farmers are south to natural antioxidant feed as it gives effective results and has an eco-friendly nature too, which can comply with stringent regulations for environmental preservation. By acknowledging this trend, many industry leaders are offering plant-based antioxidant blends to strengthen their position in the market. Producers are replacing chemicals like BHT and BHA with naturally derived antioxidants.

Animal Feed Antioxidants Market Growth Factors

- The increasing demand for high-quality animal feed contributes to market expansion.

- The rising production of livestock boosts the growth of the market.

- With the growing awareness among farmers about the health and well-being of livestock, the demand for quality animal feed is increasing, which significantly fuels market growth.

- The rising prevalence of foot-and-mouth disease among animals is one of the major factors driving the growth of the market.

Animal Feed Antioxidants Market Outlook

- Industry Growth Overview: The animal feed antioxidants market grew steadily from 2025 to 2030 due to higher consumption of animal protein and demand for high-quality meat. Adoption of animal feed antioxidants was also encouraged through the rising awareness of livestock health and feed efficiency.

- Sustainability Trends: Sustainability was an influential factor in market trends, with producers moving to more natural antioxidant sources. Companies like ADM and Cargill even began exploring bio-based antioxidants with an interest in meeting producer requirements for sustainability, as well as residue-free feed.

- Global Expansion: Leading companies in the market expanded internationally into growing markets of Southeast Asia, Latin America, and Eastern Europe to respond to rising protein consumption. For example, BASF and Kemin expanded their regional production hubs to the emerging markets to bolster local supply capabilities and reduce logistics costs.

- Key Investors: Investors focused on agri-tech and sustainable animal nutrition entered the market. Firms such as Archer Daniels Midland and Alltech attracted capital investments as a result of their innovation in natural additive formulations and their adherence to evolving global feed regulations.

- Startup Ecosystem: A new cohort of ventures centered on plant-derived and nano-encapsulated antioxidants for shelf life and bioavailability entered the market. Companies such as AgriGuard (India) and NutriSafe (USA) attracted attention for their scalable, residue-free solutions.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 368.41 million |

| Market Size in 2026 | USD 415.20 million |

| Market Size by 2034 | USD 1,058.71 million |

| Growth Rate from 2025 to 2034 | CAGR of 12.47% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Livestock, and Farm |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa |

Market Dynamics

Market Drivers

Demand for the product is anticipated to increase due to rising demand for foods high in protein.

- People are demanding more protein and nutrient-rich foods as their purchasing power and sense of health grow. Currently, the world's intake of dairy products and meat is drastically declining. The United States Department of Agriculture (USDA) reports that over the past four to five years, the per-capita consumption of goods derived from dairy has decreased by 27 pounds and increased to over 650 pounds. In a similar vein, India alone uses more than 80,000 metric tonnes (or around 176,368,000 pounds) of milk annually. In addition to dairy goods, meat consumption is rising every year. The respective market is expected to be driven by all of the aforementioned variables shortly.

Product demand is anticipated to increase as a result of quick modernization, rising economies that increase disposable money, and the growing threat of animal diseases.

- Incidences of spine flu and pathogenic avian influenza have somewhat increased. In 2009–10, when it killed more than 284,000 lives, the world health organization proclaimed the illness to be a pandemic. Furthermore, a small alteration like these viruses has been observed. According to some, there is a chance for the animal to the human transmission after a mutation. Farm owners are using a variety of feed additives to combat such dangers and to initially secure animal health. Additionally, a rapid rise in industrialization and technology is increasing people's disposable income. As a result, individuals are choosing things more logically and healthily. There are currently 670–680 million households, with the number expected to rise by 2.5–3% globally by 2030, especially if we take into account developing economies. This means that more people are escaping poverty.

Market Restraints

- Numerous adverse aspects significantly impede the expansion of the animal feed antioxidants market worldwide. One of the key reasons anticipated to slow market growth is the existence of stringent government rules governing the manufacture of antioxidant feeds.

Market Opportunity

- Animal feed antioxidants market expansion is being driven by growing concerns about animal healthcare and feed safety. Antioxidants that help increase the nutritional value of feeds and shelf life are being developed by businesses. A rise in dairy product demand is also likely to present profitable opportunities for industry participants.

Market Challenges

Lockdowns being reinstated and the rising veganism trend are expected to restrain market expansion.

- One significant aspect that is anticipated to stifle the expansion of the animal feed antioxidants market is the intensification of vegan trends and the rising vegan population. Additionally, new mutations in COVID-19 variations are causing headaches for people all over the world. Therefore, numerous nations are considering the possibility of reimposing lockdown to lessen the impact. Since this, demand and supply chains are weakening because businesses are unable to use all of their resources, and consumers are reluctant to make more purchases.

Product Insights

The market for animal feed antioxidants is further divided into two categories: natural (Vitamins, Botanical Extracts, and others) and synthetic (Propyl Gallate, Butylated Hydroxyanisole, and others). The synthetic segment dominated the market in 2024 and contributed more than 51% revenue share. In order to address the growing demand for antioxidants in animal feed, a requirement that can't be fully met by natural antioxidants, antioxidants that are synthetic are extracted on a wide scale from plant materials such as vegetables using extractions that are enzyme-assisted and ultrasound-assisted. These antioxidants that are synthetic have become a popular choice for many poultry and farm owners due to their dependability, cost, and wide availability.

The adverse effects of using synthetic antioxidants excessively are to blame for this rise. Antioxidants often have negative impacts on an animal's liver and DNA deterioration when they are removed chemically. In both monogastric (such as pigs and rabbits) and ruminant species under moderate stress circumstances, which are common in intensive livestock production, PFA (natural or plant feed additives) and Vit have a similar impact on alleviating oxidative stress. PFA delivery technique or amount can affect how the substance affects antioxidant enzyme activity.

Form Insights

The dry category is anticipated to account for a consistent revenue share during the projected period, based on form type. Dry feed antioxidants are highly sought after by livestock farmers because they are easy to handle, store, and blend with feed. The majority of feed antioxidant manufacturers on the market offer feed in dry forms such as powders, pellets, and granules due to the increased demand from numerous end-use applications.

Livestock Insights

Poultry, dairy cattle, aquaculture, swine, and others can be used to further segment the animal feed antioxidants market based on conveyance mode. The massive consumption of poultry meat around the world is responsible for the growth.According to a survey, chicken is the tastiest and most economical meat in the world, consuming more than 116 million tonnes annually. Therefore, poultry owners utilize feed additives like antioxidants and traces to meet the requirement. Utilizing food additives reduces overall costs and increases revenue. Additionally, the poultry and cattle dairy industry is predicted to develop at the quickest rate. This increase in demand for meals high in protein is due to increased health awareness among consumers. As a result, people now prioritize eating meat, milk, and related goods.

Over the next seven years, it is anticipated that the strong industrial bases for hog meat in European nations like Germany, France, and Russia will increase the supply of cattle. This would in turn spur industry expansion.

Regional Insights

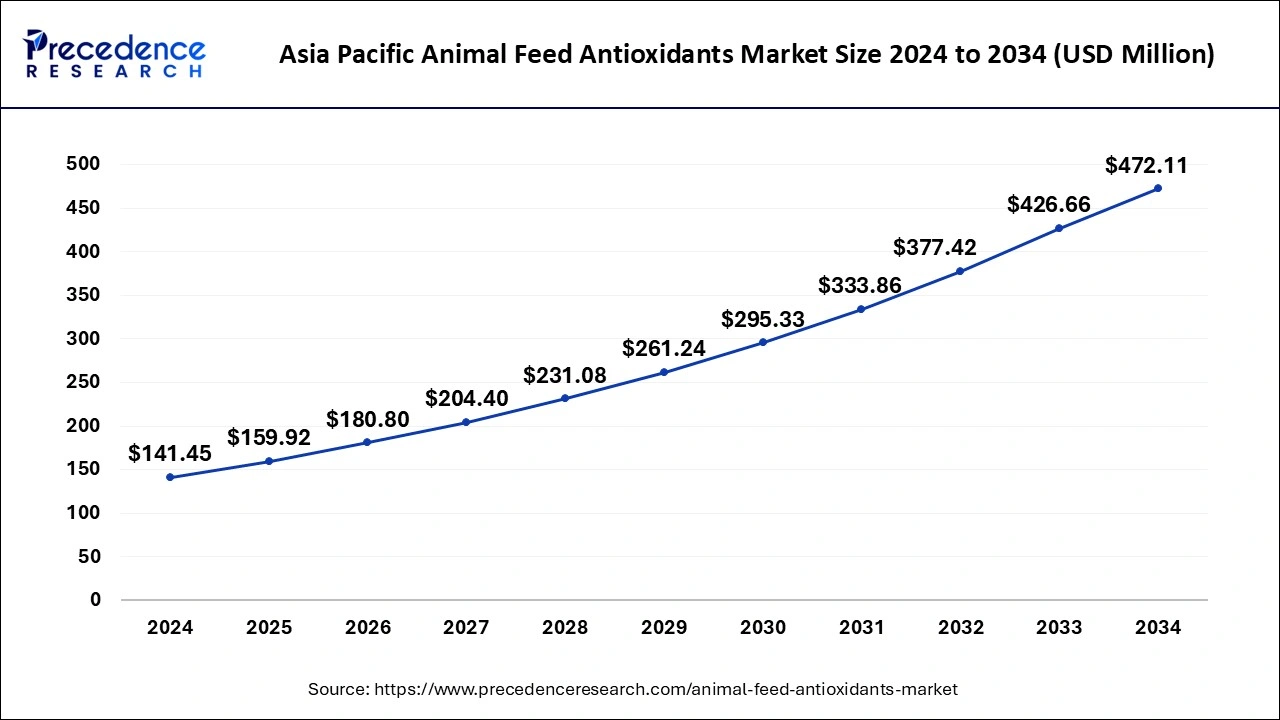

Asia Pacific Animal Feed Antioxidants Market Size and Growth 2025 to 2034

The Asia Pacific animal feed antioxidants market size is estimated at USD 159.92 million in 2025 and is predicted to be worth around USD 472.11 million by 2034, at a CAGR of 12.80% from 2025 to 2034.

It is possible to further divide the animal feed antioxidants market by geography into North America, Europe, Asia-Pacific, South America, and the Rest of the World. Due to the enormous population density on the Asian continent, there is a growing demand fordairy productsand meat, which is one of the reasons this market is expanding. In the world, China is where the majority of meat eaters reside. Pork, shellfish, and fowl from chicken and turkey make up the diet of the majority of Asian people. In China, Japan, and Indonesia, seafood including tuna, salmon, and shrimp are in practically every home. Therefore, to meet this enormous demand, meat producers are implementing modern techniques that use feed antioxidants to ensure the quality of the meat and prevent the development of disease. Asia–Pacific is also anticipated to present profitable growth prospects. This increase is the result of developing countries' booming economies, which have increased peoples' disposable income and, in turn, increased their desire for wholesome food. Over the projected period, North America is anticipated to continue to be one of the top markets, with revenue exceeding USD 40 million in 2014. High demand for these chemicals is anticipated as a result of the U.S.'s strong meat manufacturing base, which mostly consists of JBF, Tyson, Cargill, and National Beef. Rising red meat consumption in Mexico is anticipated to have a positive effect due to the expansion of stores that deliver frozen meals.

Over the next seven years, it is anticipated that the strong industrial bases for hog meat in European nations like Germany, France, and Russia will increase the supply of cattle. This would, in turn spur industry expansion.

With an estimated 25,065 kilotons of meat produced worldwide in 2013, Brazil ranked fourth. As a result of impending sporting events like the Rio 2016 Summer Olympics, demand is also anticipated to increase for meat as a source of protein and retail food establishments.

North America: Innovation at the Core of Every Feed

North America experienced consistent growth within the animal feed antioxidants industry because of established livestock farming practices and robust research & development activities. The U.S. and Canada were moving to leverage natural antioxidants to replace synthetic antioxidants, fueled by consumer preference for clean-label meats. Growth in other areas, such as pet food production and modern farming technology, presented a new market opportunity.

U.S. Animal Feed Antioxidants Market Trends

The U.S. continued to be the primary market leader, supported by established livestock markets and strong demand for safe additives. Major stakeholders in the industry, such as Cargill and ADM, developed innovative antioxidant solutions to enhance feed stability and animal health. Moreover, stringent requirements set by the FDA further supported the use of approved natural antioxidants in animal feeds for nutrition purposes.

Europe: Green Feed, Cleaner Growth

The animal feed antioxidants market in Europe expanded consistently, bolstered by stringent food safety regulations and a trend toward natural additives. The region's sustainability and environmental-conscious food production practices led feed producers to use plant-based antioxidants instead of synthetic ingredients. Investments in research and development by countries such as Germany and Spain encouraged the transition from synthetic additives to natural alternatives to meet the EU minimum feed quality regulation.

Germany Animal Feed Antioxidants Market Trends

Germany was the market leader in the European animal feed antioxidants owing to its advanced livestock management practices and increasing knowledge regarding feed safety. Producers were focused on clean-label ingredients and ecological solutions. Enabling EU regulations and the significant potential for exports backed Germany's position in the European animal feed antioxidants market.

Latin America: Sustaining Growth, Naturally

Latin America experienced consistent growth based on advancing poultry and beef production. Feed exports increased, and modernization at livestock farms also drove antioxidant demand. The region was led by Brazil and Argentina, while government programs for improving animal health and feed efficiency opened new related businesses.

Brazil was the market leader in part due to its significant meat-exporting sector, and feed manufacturers commonly use antioxidants to maintain nutritional quality during extended distance transportation. Additionally, investments in sustainable animal nutrition and partnerships with international suppliers helped Brazil maintain its leadership.

Middle East & Africa: Nourishing a New Era of Livestock Growth

The market for animal feed antioxidants in the Middle East & Africa expanded as a result of increased demand for meat and improvements in animal husbandry. Growing awareness of animal nutrition, combined with new investments in the feed manufacturing supply chain, helped drive market development in countries including Saudi Arabia and South Africa.

Saudi Arabia had the largest market in the region due to increasing poultry meat and dairy production. The government support provided for food security and domestic feed production further promoted the use of antioxidants in feed. Partnerships with companies from outside the region promoted enhanced feed quality and reduced reliance on imports.

Animal Feed Antioxidants Market Companies

- Cargill

- DSM Nutritional Products

- Adisseo

- Novozymes

- Beldem

- Alltech

- Ab Vista

- Dupont

- Zhenjiang Medicine

- Kemin Industries

Recent Developments

- In December 2024, a leading producer of aquafeed, BIOMAR, introduced a new functional feed aimed at addressing the enduring challenges of farmed fish, including outbreaks of salmonid rickettsial septicemia. SmartCare endurance is a newly launched feed that includes a blend of antioxidants, vitamins, and minerals that work together to offer optimum results by reducing oxidative stress. The repetitive use of this feed has shown excellent results, like improvement in the rate of survival and reduced tissue damage.

- In September 2024, a leading group in aquaculture feeds from India, known as the Growel group, announced its first step into the rapidly growing pet food industry, along with the launch of its new product, CARNIWEL. This product offers a high-quality range for pets, catering to their evolving needs as they progress through various growth stages.

- In September 2024, Growel Group announced a strategic expansion into the growing pet food sector with the launch of its new pet food brand, Carniwel. The company said Carniwel aims to meet the rising demand for premium pet nutrition at affordable prices.

- In May 2024, Kemin Industries submitted a request to the European Commission to allow the use of liquid rosemary extract as an antioxidant feed additive for cats and dogs and has received authorization through Commission Implementing Regulation (EU) 2024/1068. Rosemary extract is an effective antioxidant that helps pet food manufacturers meet the growing demand for clean-label, high-quality, and environmentally friendly products.

Segments Covered in the Report

By Product

- Natural

- Synthetic

By Livestock

- Swine

- Cattle

- Poultry

- Aquaculture

By Form

- Dry

- Liquid

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- MEA

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client