List of Contents

What is the Agricultural Chelates Market Size?

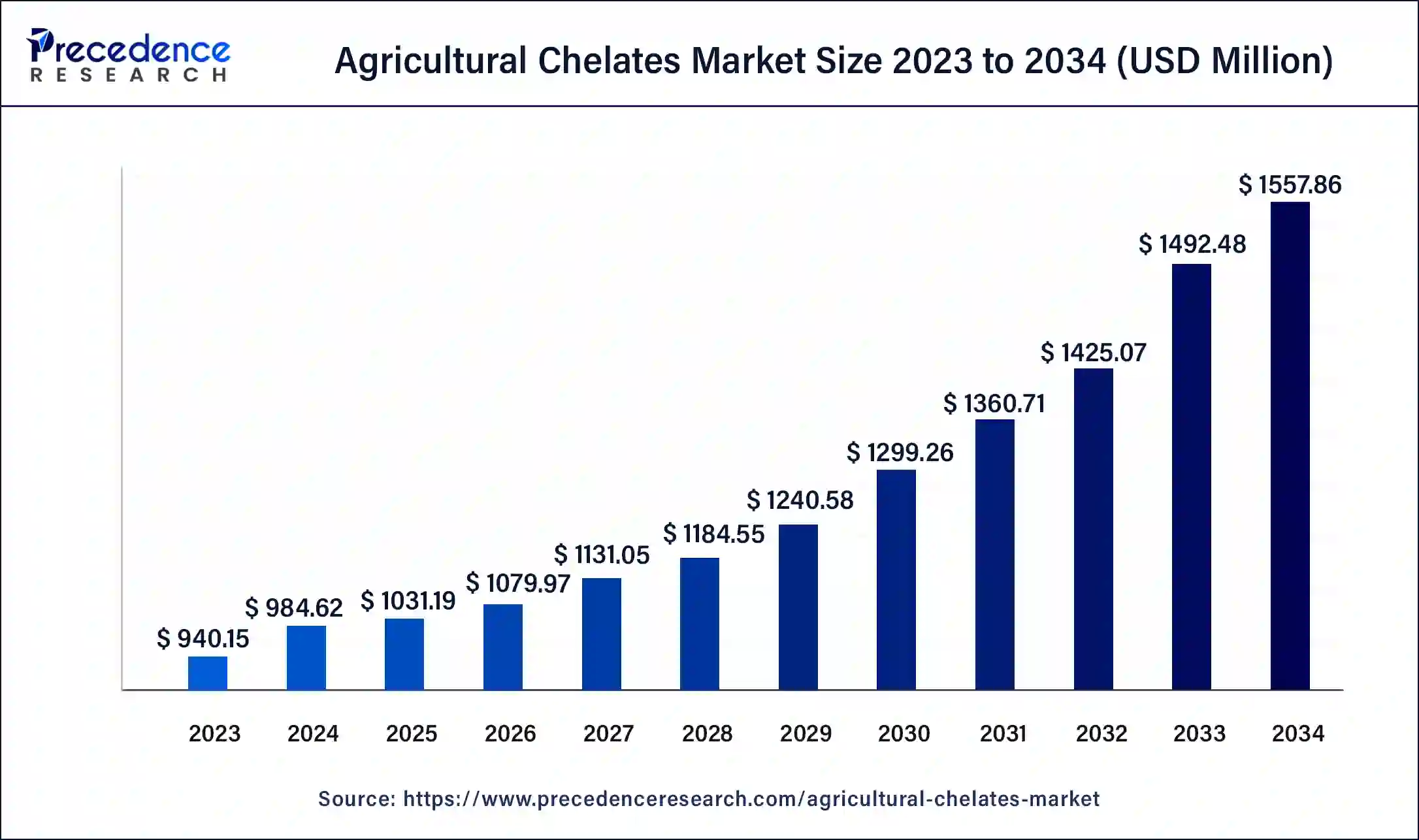

The global agricultural chelates market size is valued at USD 1031.19 million in 2025, calculated at USD 1079.97 million in 2026, and is expected to reach around USD 1557.86 million by 2034, expanding at a CAGR of 4.69% from 2025 to 2034. The agricultural chelates market is driven by the growing need for high-value crops.

Agricultural Chelates Market Key Takeaways

- In terms of revenue, the agricultural chelates market is valued at USD 1,031.19 million in 2025.

- It is projected to reach USD 1,557.86 million by 2034.

- The agricultural chelates market is expected to grow at a CAGR of 4.69% from 2025 to 2034.

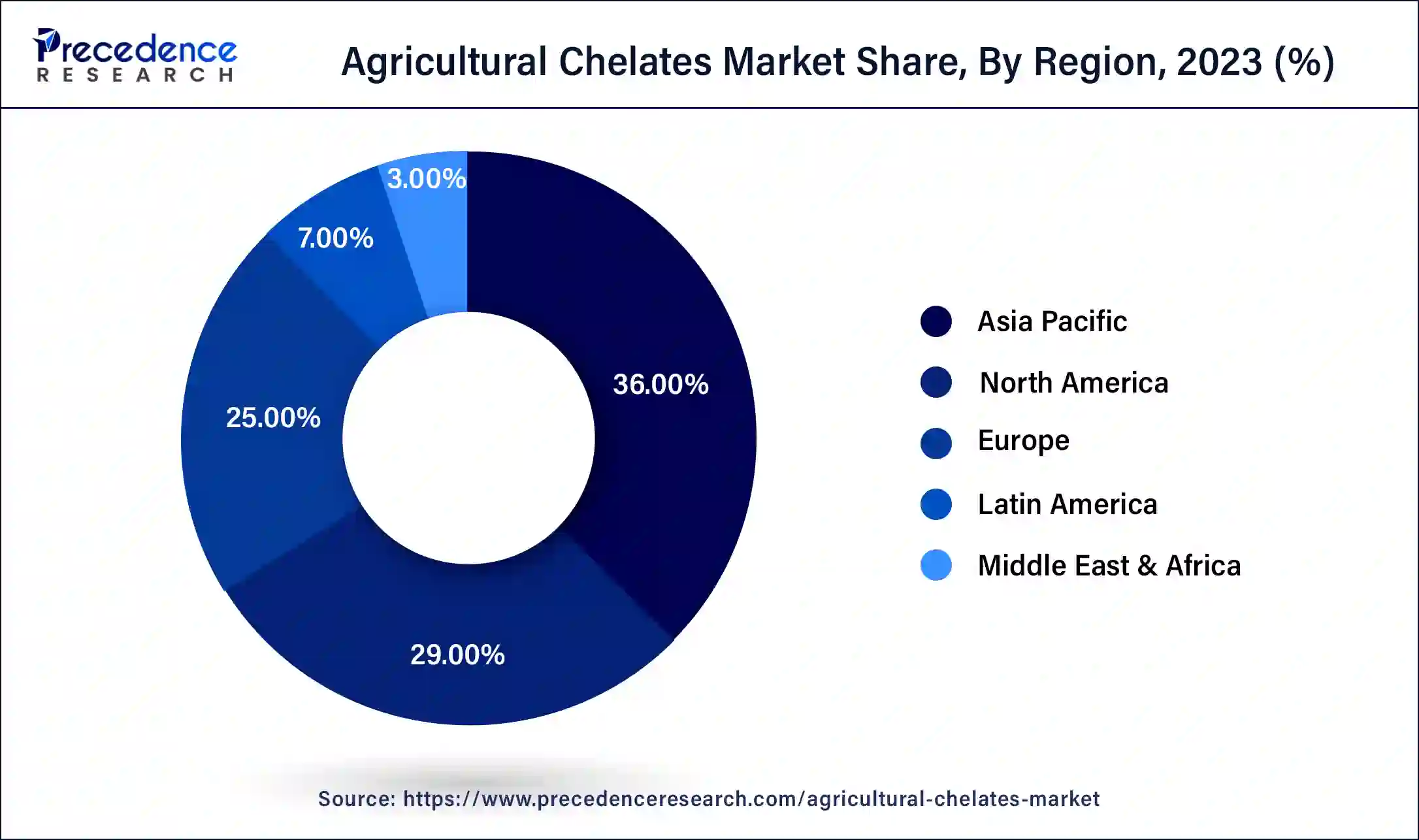

- North America dominated market with the largest market share of 36% in 2024.

- By type, the EDTA segment has generated over 35% of market share in 2024.

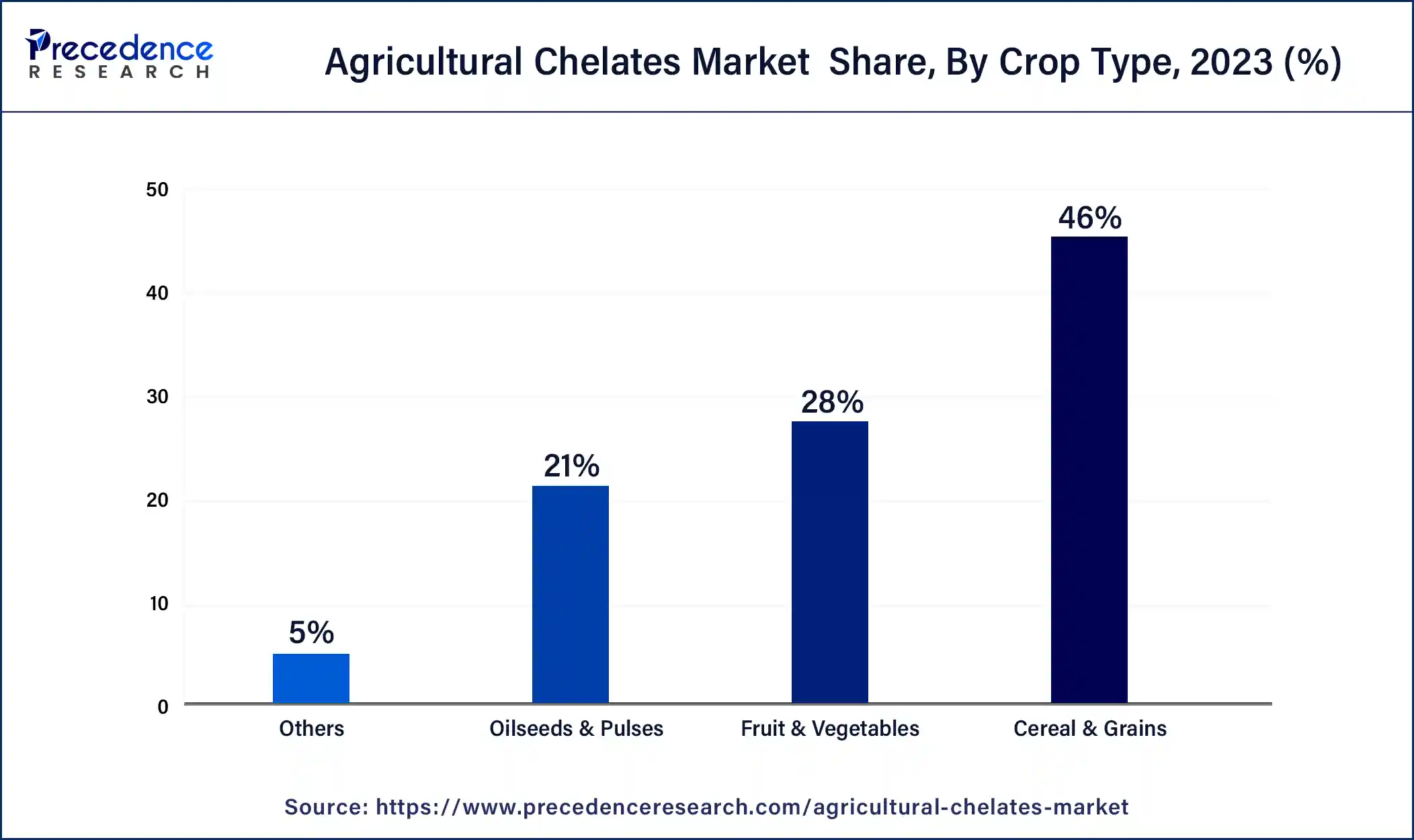

- By crop type, the cereal & grains segment has contributed more than 46% of market share in 2024.

- By mode of application, the soil treatment segment has held the biggest market share of 41% in 2024.

- By end-use, the agriculture segment has recorded over 56% market in 2024.

Agricultural Chelates Market Outlook:

Global Expansion: A significant catalyst is the accelerating demand for higher agricultural productivity and optimized crop quality, mainly in regions with soil micronutrient deficiencies.

Major Investor: Companies like Nouryon Holding B.V., BASF SE, and Yara International ASA are widely investing in enhancing their biodegradable solutions.

Startup Ecosystem: Nanosoils Bio (Australia) is exploring nanotechnology to accelerate seed germination and crop resilience under challenging climate conditions.

What are the Broader Benefits of Agricultural Chelates?

The agricultural chelates market refers to the industry that produces and distributes chelated micronutrients used in agricultural practices. Chelates are chemical compounds in which a metal ion is bonded to an organic molecule to form a ring-like structure, known as a chelate complex. These chelated micronutrients are essential for plant growth and supplement soil and foliar applications in agriculture.

The purpose of agricultural chelates is to improve plant nutrient availability and uptake. Chelation helps prevent nutrient deficiencies by improving the stability and solubility of micronutrients such as iron (Fe), manganese (Mn), zinc (Zn), copper (Cu), etc. These micronutrients play a vital role in various biochemical processes within plants, which include photosynthesis, enzyme activation, and overall plant growth and development.

- In March 2022, The Haifa Group entered into a purchase agreement with HORTICOOP BV to purchase Horticoop Andina, a wholesaler specializing in selling nutritious agricultural products in Quito, Ecuador.

Agricultural Chelates Market Growth Factors

- The consumer is demanding more fruits, vegetables, and other nutrient-rich crops. Thereby, chelates can improve the quality and yield of these crops.

- Chelates help deliver these nutrients to plants in a usable form, as modern farming practices can deplete the soil of essential micronutrients.

- There is a popularity of biodegradable chelates as farmers look for environmentally friendly ways to enhance crop health.

- With a growing population, more farmable land needs to be available. Chelates can help maximize crop yields on existing land.

Market Scope

| Report Coverage | Details |

| Global Market Size by 2034 | USD 1557.86 Million |

| Global Market Size in 2026 | USD 1079.97 Million |

| Global Market Size in 2025 | USD 1031.19 Million |

| Growth Rate from 2025 to 2034 | CAGR of 4.69% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Crop Type, Mode of Application, End-use, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growing trends of precision agriculture

Using GPS, drones, and sensors, precision agriculture allows farmers to assess field variations in soil nutrients, moisture levels, and other characteristics. Farmers can apply site-specific nutrient management strategies by accurately identifying these variances. Agricultural chelates are critical in minimizing waste, guaranteeing proper plant nutrition, and providing targeted nutrients to certain field areas. It uses digital platforms and data analytics to make well-informed judgments regarding crop management.

Farmers may improve their agronomic practices by gathering and evaluating data on plant nutrition, weather patterns, soil health, and yield variability. Farm productivity is increased using agricultural chelates and data-driven insights to treat specific nutrient deficits found by soil testing or remote sensing.

Rising awareness about micronutrient deficiencies

Significant technical developments in the agricultural sector have included data analytics, remote sensing, and precision agriculture. Due to this technology, farmers can now precisely monitor crop health, soil conditions, and nutrient levels. To meet crop-specific requirements, there is a greater emphasis on targeted nutrient management and micronutrient-enriched fertilizers.

Restraint

Limited adoption in traditional practices

Erosion, inadequate irrigation techniques, and the overuse of chemical fertilizers are the main causes of soil degradation in many parts of the world. The soil's unbalanced pH values may, therefore, lower plant nutrition availability. Agricultural chelates are designed to bind or chelate with micronutrients so that plants may more easily access and utilize them, even in less-than-ideal pH soils. This ability is essential for preserving soil fertility and productivity in deteriorated or acidic soils.

Opportunity

Technological advancements in agriculture

The market for agricultural chelates has undergone even more radical change with the advent of nanotechnology. The term "nano-chelates" refers to nano-sized chelated micronutrient particles with superior stability, nutrient release characteristics, and surface area. These nano-chelates ensure better crop utilization and nutrient absorption by penetrating plant cells more effectively. Manufacturers of agricultural chelates are progressively integrating their products with agronomy software and digital farming platforms.

Through this interface, farmers may monitor crop response in real-time, track application rates, and receive individualized suggestions for nutrient management. These platforms use machine learning algorithms and data analytics to optimize chelate consumption for optimal agricultural advantages.

Type Insights

The EDTA segment dominated the agricultural chelates market in 2024. When it comes to providing plants with vital micronutrients like iron (Fe), manganese (Mn), zinc (Zn), copper (Cu), and others, EDTA chelates are incredibly adaptable and efficient. These micronutrients are essential for several physiological functions, such as photosynthesis, the activation of enzymes, and the general growth and development of plants. EDTA chelate-containing agricultural formulations come in various forms, including granules, soluble powders, and liquid solutions. Farmers may easily apply EDTA chelates using various application techniques, including foliar spraying, soil soaking, and fertigation (application through irrigation systems), because of the formulation's adaptability.

The DTPA segment is observed to be the fastest growing agricultural chelates market during the forecast period. Five carboxylic acid groups make up DTPA's structure, making it a powerful chelating agent. DTPA forms stable complexes with metal ions, including Fe3+, Cu2+, Zn2+, and Mn2+, with high charge densities. By preventing precipitation and locking vital micronutrients into a state that plants can readily absorb, these chelates increase nutrient uptake efficiency. Farmers and other agricultural professionals are implementing micronutrient management techniques more frequently due to rising awareness of how micronutrient deficits impact crop productivity and quality. DTPA chelates provide a dependable option to treat deficiencies, improve plant health, and give plants access to micronutrients in a bioavailable form.

Crop Type Insights

The cereal & grains segment dominated the agricultural chelates market in 2024. Grain and cereal crops require a lot of nutrients during different growth phases. These crops need a balanced supply of micronutrients for optimal growth and productivity, including zinc, iron, manganese, and copper. Chelated micronutrients ensure that these crops obtain the critical elements required for maximum growth and yield since they are more efficient and available to plants than traditional forms. Environmental impact reduction and sustainable techniques are becoming increasingly important in modern agriculture.

The benefits of chelated micronutrients include less runoff and leaching, which improves plant nutrient uptake and lessens environmental pollution. The use of chelates is further encouraged by regulatory support for sustainable farming techniques, particularly in ecologically vulnerable areas where traditional fertilizers may provide hazards.

The fruit & vegetables segment is the fastest growing segment in the agricultural chelates market during the forecast period. Consumers seek premium, nutrient-rich fruits and vegetables as they become more health-conscious. The demand for products that have improved nutritional content, and their attractive appearance has surged due to this trend. By facilitating improved absorption of vital elements, including iron, zinc, manganese, and copper, agricultural chelates contribute to the increased nutrient content of fruits and vegetables. Sustainable farming practices are becoming increasingly popular as people become more conscious of the negative impacts of chemical fertilizers and the sustainability of the environment.

Agricultural chelates provide a more environmentally responsible method of managing nutrients than conventional fertilizers. They help farmers achieve maximum crop yields while minimizing environmental impact by reducing nutrient leaching and runoff.

The oilseeds & pulses segment is observed to show a significant growth in the agricultural chelates market during the forecast period.

Compared to conventional fertilizers, agricultural chelates provide a more effective and environmentally friendly method of delivering plant micronutrients. The chelation technique minimizes waste and its negative effects on the environment by extending the time that nutrients are available to plants. Regardless of the pH or other properties of the soil, oilseeds and pulses are frequently cultivated in various agroclimatic situations, and the application of chelated micronutrients helps maximize nutrient availability. Because of their adaptability, chelates are desirable for farmers growing these crops.

Mode of Application Insights

The soil treatment segment dominated the agricultural chelates market in 2024. The pH of the soil is a significant factor in the nutrient's plants can get. Certain micronutrients, such as iron and zinc, are less accessible to plants in alkaline soils, which can result in shortages and poor crop production. By preserving these micronutrients in a soluble and bioavailable state even in high pH soils, chelates aid in overcoming this restriction. Chelates can also enhance the cation exchange capacity, soil structure, and water retention of the soil, improving the conditions for plant roots' growth and the uptake of nutrients.

End-use Insights

The agriculture segment dominated the agricultural chelates market in 2024. Farmers and growers use agricultural chelates to increase farm output and maximize production. Chelates help to improve plant health, resistance to pests and diseases, and tolerance to environmental challenges like salt and drought by ensuring that plants obtain the proper balance of nutrients. All these elements work together to create higher yields and higher-quality products necessary to meet the world's food needs.

Various crops, including cereals, fruits, vegetables, legumes, and ornamentals, are grown with agricultural chelates. Since their products can be used in a wide range of crop needs and farming systems worldwide, their broad application increases the market reach of chelate makers and suppliers.

Regional Insights

How did the Asia Pacific Dominate the Market in 2024?

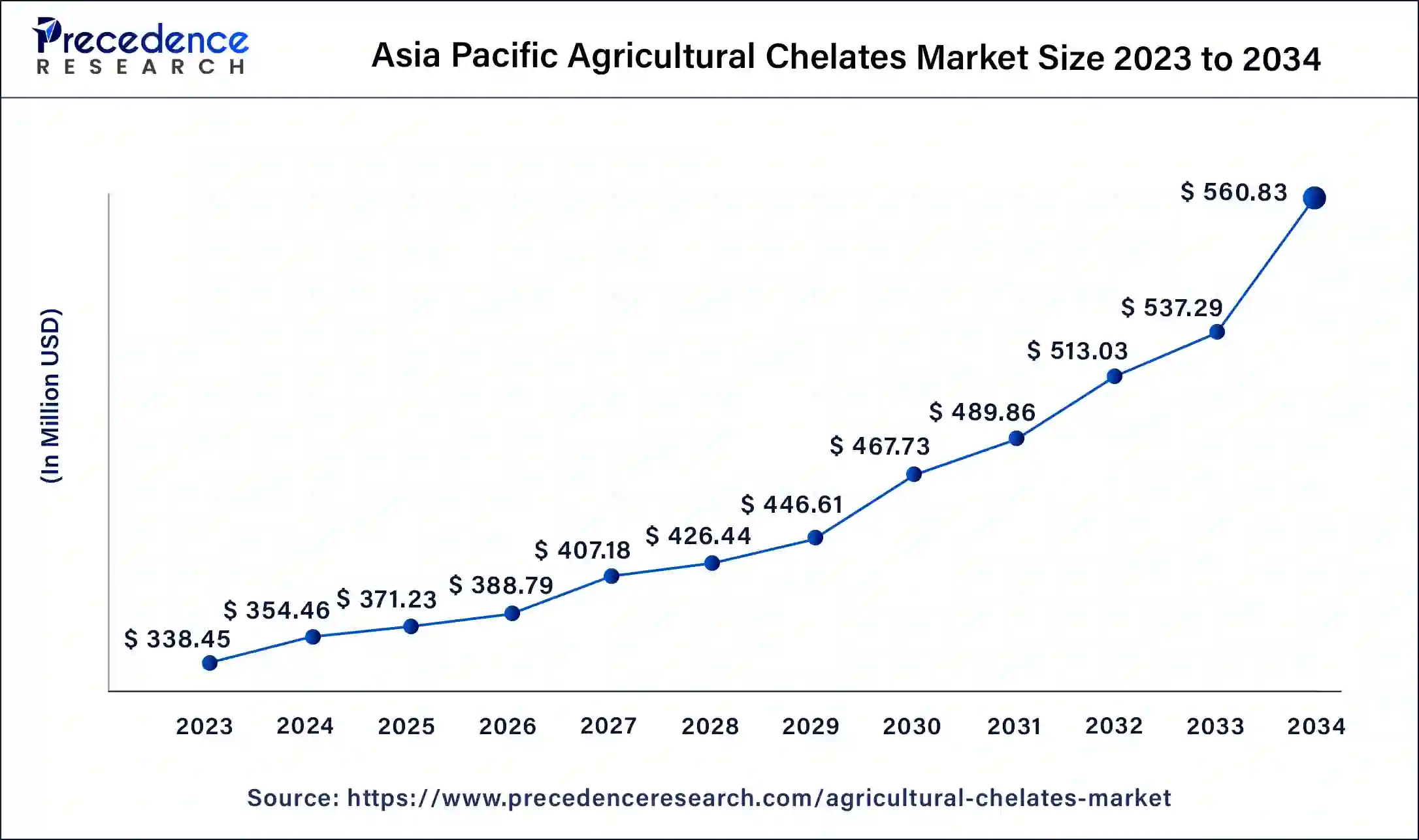

The Asia Pacific agricultural chelates market size is estimated at USD 371.23 million in 2025 and is projected to surpass around USD 560.83 million by 2034 at a CAGR of 5% from 2025 to 2034.

Asia-Pacific has its largest market share in 2024 in the agricultural chelates market. To supply the region's expanding population with food, agriculture has rapidly expanded in the area. Agricultural chelates are used more frequently due to this expansion to raise crop yields, improve nutrient uptake, and improve soil fertility. To increase production and sustainability, farmers in the Asia-Pacific region are progressively implementing sophisticated farming techniques. This covers integrated nutrient management systems, precision agriculture, and greenhouse farming. Agricultural chelates are essential to these methods because they minimize soil degradation, reduce nutrient losses, and guarantee that crops have the best possible nutrient availability.

Countries like India and China are leading the Asian agriculture chelates market due to a wide and expanding agricultural sector. The growing population has increased demand for food production across these countries, leading to the need for improved crop yield production. Government initiatives and funding for agriculture further contribute to the market growth.

Shifting Towards Green Chelates: Fosters the Indian Market

The presence of products from the global leading companies in India is promoting next-generation, readily biodegradable chelating agents. Such as in April 2025, BASF introduced Trilon G (GLDA-based). Also, an extensive government program, including the National Mission on Natural Farming and the Digital Agriculture Mission, is encouraging sustainable practices and technology integration.

- In January 2025, Uttar Pradesh Chief Minister Yogi Adityanath established a 4,000-crore project to enhance agriculture productivity by up to 35% and support the rural enterprise ecosystem. This six-year project will be executed across the UP till 2029-30. (Source: https://agrospectrumindia.com)

Incorporation of Tailored Solutions is Driving North America

North America shows a significant growth in the agricultural chelates market during the forecast period. Fruits, vegetables, and high-value crops are among the horticultural and specialty crop production increasing in North America. These crops are grown in controlled conditions where fertilizer management is crucial and frequently have specialized nutritional requirements. The customized solutions agricultural chelates provide for these crops encourage growers concentrating on specialist markets to adopt them.

- In March 2022, Biotron Laboratories and Talus Mineral Company, producers of specialty ingredients for the nutritional supplement market, acquired Aceto, the go-to source for life sciences and cutting-edge technology specialty ingredients. The acquisition strengthens Aceto's footprint in the life science sector and expands its current nutraceuticals business.

- In March 2025, the U.S. Department of Agriculture (USDA) implemented up to $10 billion directly to agricultural producers through the Emergency Commodity Assistance Program (ECAP) for the 2024 crop year, Passed under the?American Relief Act of 2025, according the U.S. Secretary of Agriculture Brooke Rollins announcement on National Agriculture Day. ECAP is administered by the USDA's Farm Service Agency (FSA) to help agricultural producers reduce increased input costs and falling commodity prices. (Source: https://www.usda.gov)

Immersive Precision Agriculture Integration: Impacts the U.S. Market

The prospective expansion of the agricultural chelates market in the U.S. will be driven by a rise in the development of chelating agents that are compatible with advanced farming technologies, like drones, soil sensors, and GPS-guided application systems, to accelerate nutrient delivery and lower waste. Furthermore, this encompasses the progression of specific liquid and powdered formulations for use in fertigation and foliar sprays.

Ongoing Advanced Strategies are Assisting MEA

The MEA market has been impacted by a notable step into highlighting particular micronutrient deficiencies, like zinc deficiency in Turkey. Along with this, they are leveraging well-planned warehousing hubs in the Middle East & Africa for the efficient management of various national necessities and ensuring robust, cross-border movement of chelates.

Revolutionary Government Efforts: Explores the African Market

An eventual growth of the market is empowered by the greater contribution of the Comprehensive Africa Agriculture Development Programme (CAADP), which has been adopted by the African Union and has an action plan (2026-2035) in January 2025 to boost agrifood output by 45%. This mainly focuses on sustainable food production and value addition, which needs effective nutrient management practices consisting of chelates.

Agricultural Chelates Market: Value Chain Analysis

- Harvesting and Post-Harvest Handling

Emerging chelates are highly used during the growing season to mitigate or correct nutrient deficiencies, with particular application timing and management protocols employed at harvest and post-harvest to boost crop quality and storage life.

Key Players: ICL, Haifa Chemicals, Aries Agro, etc. - Processing and Packaging

This prominently comprises specific chemical reactions followed by mechanical procedures to produce a stable, usable product.

Key Players: Syngenta Group, The Andersons, Inc., UPL Limited, etc. - Export and Trade Compliance

For compliance, it involves product classification, registration with regulatory agencies, proper documentation, and adherence to specific market needs.

Key Players: Auxilife Scientific Services Pvt. Ltd., Law Hunt Solution India Pvt. Ltd., Manderstam, etc.Top Companies and Their Offerings in the MarketTop Companies and Their Offerings in the Market

Top Companies and Their Offerings in the Market

|

Company Name |

Key Offerings |

Market Contributions |

|

BASF SE |

Produces iron and zinc chelates, expanding nutrient efficiency |

Drives global adoption through sustainable formulations and strong agronomic support |

|

Nufarm Limited |

Offers versatile chelated micronutrients enhancing crop vigor |

Strengthens market presence by tailoring solutions to regional soils and farming needs |

|

Syngenta AG |

Develops reliable EDTA-based chelates improving nutrient uptake |

Supports farmers with integrated plant nutrition programs and distribution networks across regions |

|

The Dow Chemical Company |

Supplies advanced chelating agents improving fertilizer stability |

Contributes chemical expertise enabling consistent micronutrient delivery in diverse agricultural key applications |

|

AkzoNobel N.V. |

Provides essential chelating intermediates supporting nutrient formulations |

Enhances market availability through production, innovation, and reliable supply to global agriculture |

Other Companies

- Aries Agro Limited

- Valagro S.p.A.

- Yara International ASA

- Protex International

- Van Iperen International

- Arysta LifeScience Corporation

Recent Developments

- In April 2025, BASF unveiled its readily biodegradable dispersant, Sokalan?CP 301, which offers optimal performance for existing agricultural formulations. BASF launched the Sokalan?CP 301 in response to global regulations requiring safe and more sustainable chemicals in the environment. (Source: https://www.basf.com)

- In April 2025, BASF launched its sustainable chelating agent solution, Trilon?G, which uses glutamic acid diacetate (GLDA) chemistry. The launch complements the company's range of chelating agents, including EDTA and MGDA. (Source; https://www.basf.com)

- In January 2025, the joint study into the stable supply of phenol-related products, including phenol, acetone, α-methylstyrene, bisphenol A, and methyl isobutyl ketone, was launched by Mitsui Chemicals and Mitsubishi Chemical Corporation. The products are widely used as raw materials for polycarbonate resin, phenolic resin, methyl methacrylate, epoxy resin, paints, and more, influencing Japan's economic security. (Source: https://www.indianchemicalnews.com)

Segments Covered in the Report

By Type

- EDTA

- DTPA

- EDDHA

- IDHA

- Others

By Crop Type

- Cereal & Grains

- Fruit & Vegetables

- Oilseeds & Pulses

- Others

By Mode of Application

- Foliar Spray

- Soil Treatment

- Fertigation

- Seed Treatment

- Others

By End-use

- Agriculture

- Horticulture

- Floriculture

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client