List of Contents

What is the Acrylic Fibers Market Size?

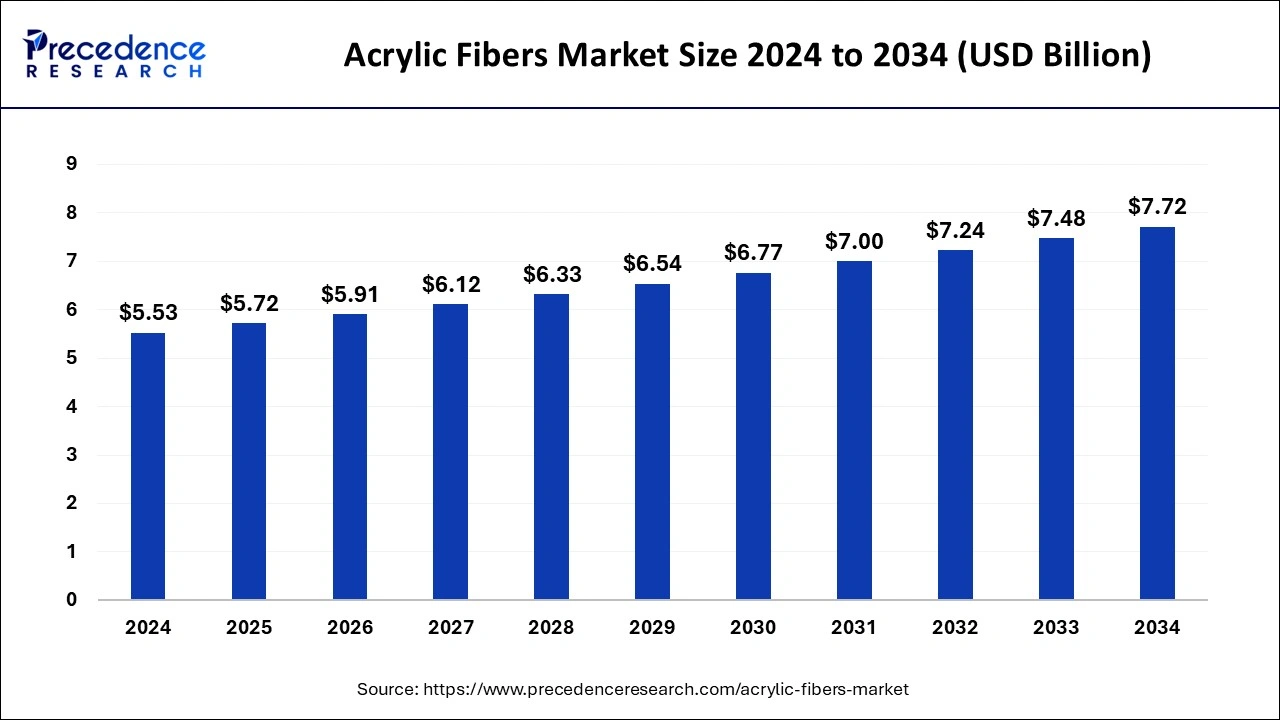

The global acrylic fibers market size accounted for USD 5.72 billion in 2025 and is predicted to increase from USD 5.91 billion in 2026 to approximately USD 7.72 billion by 2034, expanding at a CAGR of 3.39% from 2025 to 2034. The market perception of acrylic fibers is largely a result of initiatives to create recycling programs, environmentally friendly manufacturing techniques, and sustainable raw material sources.

Acrylic Fibers Market Key Takeaways

- The global acrylic fibers market was valued at USD 5.53 billion in 2024.

- It is projected to reach USD 7.72 billion by 2034.

- The acrylic fibers market is expected to grow at a CAGR of 3.39% from 2025 to 2034.

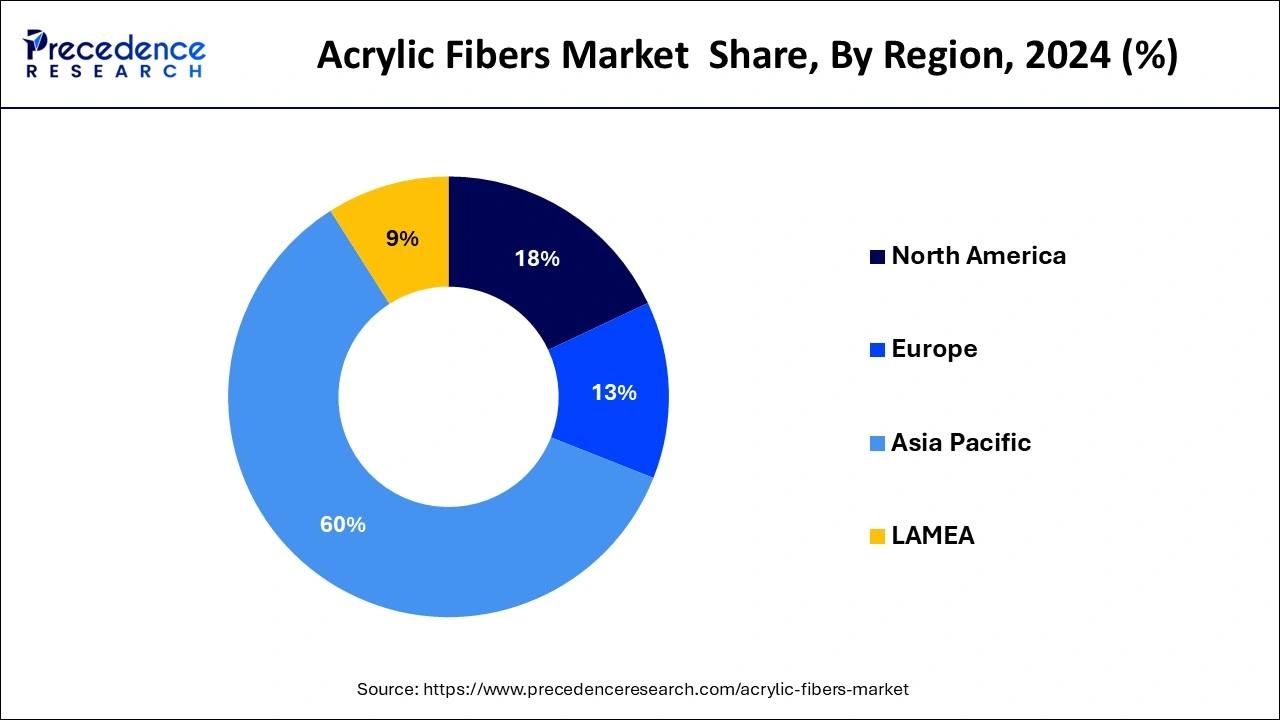

- Asia Pacific led the market with the largest market share of 60% in 2024.

- By fiber type, the staple fibers segment led the market with a major market share of 74.60% in 2024.

- By fiber type, the tow-dyed acrylic fibers segment is expected to grow at a significant CAGR of 4.90% over the projected period.

- By dyeing method, the acid dyeing segment dominated the market with the largest share of 48.30% in 2024.

- By dyeing method, the gel dyeing segment is expected to grow at a significant CAGR of 5.60% from 2025 to 2034.

- By blending, the wool blends segment held the biggest market share of 52.70% in 2024.

- By blending, the cotton blends segment is expanding at a significant CAGR of 4.70% from 2025 to 2034.

- By end-use application, the apparel segment led the market share of 38.20% in 2024.

- By end-use application, the healthcare industry is expected to grow at a significant CAGR of 6.30% over the projected period.

Acrylic Fibers Market Outlook:

Global expansion: This is eventually fueled by a robust demand from the apparel, home furnishing, and automotive sectors.

Major Investors: Aksa Akrilik Kimya Sanayii A.Åž., Aditya Birla Group & other like firms are investing in expanding their manufacturing capacities.

Startup Ecosystem: Szoneier Fabrics, a startup emphasizing sustainable acrylics, such as using recycled fibers and waterless dyeing technologies.

What are the Immersive Trends of the Acrylic Fibers?

Because acrylic fibers have qualities similar to those of wool, including warmth, softness, and moisture-wicking ability, they are widely used in the clothing business. They are frequently utilized in sportswear, socks, and sweaters. Because acrylic fibers resist mildew, insects, and fading from sunshine, they are utilized in carpets, upholstery, and blankets. Also, these fibers are strong and long-lasting; they are used in industrial items, including filters, awnings, and ropes. There is a significant reach for the acrylic fibers market in these areas as well, especially for industrial and household furnishings.

The expanding textile and industrial sectors of Latin America and Africa are making these regions attractive for the acrylic fibers market players. In order to create sophisticated acrylic fibers with improved qualities like flame resistance, dyeability, and sustainability, businesses are concentrating on research and development. A growing emphasis is being placed on creating eco-friendly manufacturing processes and generating acrylic fibers from recycled resources due to growing environmental concerns.

Mergers and acquisitions are driving the acrylic fibers market consolidation as businesses look to bolster their market positions and diversify their product lines. Although acrylic fibers have some benefits, there is rising worry about their influence on the environment, especially in relation to microplastic contamination. As a result, there is more scrutiny and demand for sustainable alternatives. The market for acrylic fibers was first affected by the COVID-19 pandemic because it caused supply chain interruptions and reduced consumer expenditure on non-essential items.

Acrylic Fibers Market Growth Factors

- The clothing industry uses acrylic fibers because of their warmth, softness, and ease of dyeing. The need for acrylic fibers rises as the apparel industry grows, particularly in emerging areas in the acrylic fibers market where disposable incomes are expanding.

- Because acrylic fibers are less expensive and have comparable qualities to wool, they are frequently employed as an alternative. Concerns about animal welfare or a rise in the price of wool could spur demand for acrylic fibers.

- Acrylic fibers are widely utilized in non-woven fabrics, such as car interiors, medical items, and hygiene products, among other applications. The acrylic fibers market is expanding due to these industries' rising need for non-woven materials.

- Because acrylic fibers are long-lasting and low care, they are frequently used in household furnishings such as carpets, blankets, and upholstery. Acrylic fibers are becoming more and more in demand for these applications as the housing industry expands and consumers spend more on home decor.

- The need for building materials, such as acrylic fibers used in concrete reinforcement and other construction applications, is increased by infrastructure development initiatives, especially in emerging nations.

- The acrylic fibers market is positively impacted by overall economic growth, especially in areas with substantial textile and clothing manufacturing industries. This is because such growth increases consumer spending and industrial production.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 5.72 Billion |

| Market Size in 2026 | USD 5.91 Billion |

| Market Size by 2034 | USD 7.72 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 3.39% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Fiber Type, Application, and End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa |

Market Dynamics

Driver

Eco-friendly options

Recycling lessens the environmental impact of raw material extraction and processing while also reducing the demand for virgin materials. Bio-based acrylic fibers made from renewable resources like corn, sugarcane, or other plant-based materials are the result of research and development activities. In order to lower energy, water, and emission levels while producing acrylic fibers, several producers are putting eco-friendly production techniques into practice. Because acrylic fibers are well-known for being strong and long-lasting, they can promote sustainability by lowering the need for regular replacements and lengthening the life of products created with them.

Restraint

Innovation and differentiation

Provide acrylic fibers with better performance attributes, like increased abrasion and chemical resistance, moisture-wicking capabilities, strength, and durability. Put your attention on creating environmentally friendly acrylic fibers by recycling, using sustainable sourcing techniques, and minimizing the impact of production on the environment. Be creative when it comes to color and design. Provide acrylic fibers with eye-catching hues, distinctive textures, and captivating visual effects to satisfy the demands of the interior design and fashion industries. Give customers the ability to customize the color, thickness, texture, and performance aspects of acrylic fibers to suit their unique needs. This may entail creating goods specifically for each client or customizing solutions for certain purposes.

Opportunity

Innovations in acrylic fiber technology

The goal of innovations in the production of acrylic fibers has been to increase the fibers' comfort and softness, which makes them more desirable for usage in clothing items like sportswear, socks, and sweaters. These developments extend the lifespan of acrylic fibers and improve their appropriateness for a variety of end applications, including upholstery, carpets, and industrial settings. Acrylic fibers are now more resistant to abrasion, stretching, and tearing. The exceptional color retention and fade resistance of acrylic fibers have been further improved by advancements in dyeing methods and additives. Innovations in acrylic fiber technology have also focused on lessening the production processes' environmental impact, which is in line with the growing emphasis on sustainability.

Fiber Type Insights

The staple fibers segment dominated the acrylic fibers market in 2024, largely due to its versatility and wide range of applications in textiles, particularly in apparel and home furnishings. These fibers, characterized by their short lengths, are commonly used in clothing, blankets, upholstery, and other home products. Their ability to mimic the feel and appearance of wool, combined with affordability, makes them a popular choice in both sectors. Recent innovations have enhanced the softness, drape, and colorfastness of staple acrylic fibers, further broadening their appeal across various applications. They are particularly suitable for mass production, making them ideal for a diverse array of products.

The tow-dyed acrylic fibers segment is expected to experience rapid growth during the forecast period. This growth is mainly attributed to its superior colorfastness, uniformity, and cost-effectiveness compared to other acrylic fiber types and alternatives, particularly in applications such as outdoor fabrics, upholstery, and carpets. Tow-dyed acrylic fibers offer excellent color retention and consistent coloration, making them ideal for applications where these properties are crucial. Additionally, the expanding global apparel and nonwovens industries, along with advancements in fiber technology focused on enhancing the strength, durability, and environmental resistance of acrylic fibers, are driving this growth.

Dyeing Method Insights

The acid dyeing segment maintained its dominant position in the market in 2024. This is due to its ability to produce bright, vibrant colors with good lightfastness and washfastness on protein fibers like wool, silk, and nylon, as well as modified acrylics. Acid dyes ensure that colors remain vibrant over time and are suitable for dyeing certain acrylic blends, thereby expanding their application in the market. While cationic dyes are the preferred choice for dyeing pure acrylic fibers, acid dyes are used for acrylic blends and applications requiring their specific properties.

The gel dyeing segment is projected to grow the fastest in the market over the forecast period. This is attributed to its numerous advantages, including reduced water and energy consumption, minimized wastewater discharge, and decreased dye usage compared to conventional methods. These benefits align with growing environmental concerns and stricter regulations regarding textile dyeing processes. Gel dyeing offers a more sustainable and cost-effective solution, reflecting increasing regulatory pressure and consumer demand for eco-friendly products. The fashion industry's focus on sustainability is driving the demand for gel-dyed acrylic fibers.

Blending Insights

The wool blends segment led the market in 2024, primarily driven by the desirable combination of properties these blends offer, such as warmth, softness, durability, and cost-effectiveness. Blending acrylic fibers with wool creates fabrics that replicate the luxurious feel of wool while enhancing durability and reducing cost, providing comfort and longevity. The rising demand for wool blend fabrics is fueled by their aesthetic appeal, ease of maintenance, and adaptability to various climates. Additionally, the growing emphasis on sustainable practices in the textile industry has led to an increased use of Responsible Wool Standard-certified wool in blends, further boosting this segment.

The cotton blends segment is expected to grow the fastest during the forecast period due to the enhanced properties and versatility they provide. Cotton-acrylic blends combine the comfort, breathability, and absorbency of cotton with the durability, wrinkle resistance, shape retention, and warmth of acrylic, making them suitable for various applications such as apparel, home textiles, and sportswear. Advances in technologies and processes have made it easier and more affordable to produce high-quality cotton-acrylic blends. The growing demand for durable and stain-resistant fabrics is also contributing to the rise of cotton-acrylic blends in home furnishings.

End-Use Application Insights

The apparel segment captured the dominant position in the market in 2024. This dominance is primarily due to acrylic fibers' desirable properties for clothing, including softness, warmth, and affordability. The increasing demand for comfortable and functional apparel like sportswear and athleisure, has also contributed to this dominance. Compared to natural fibers like wool, acrylic fibers offer a more cost-effective option, making them attractive to both manufacturers and consumers. Acrylic fibers are resistant to wrinkles, shrinkage, and pests, and they can be blended with other fibers to enhance their performance in clothing. Furthermore, the growth of online retail has increased market accessibility, broadening consumer preferences.

The healthcare industry segment is considered the fastest-growing within the market. This is mainly due to the increasing demand for specialized protective clothing and medical textiles. This includes items like surgical gowns, drapes, and wound care products, where their properties like durability, softness, and resistance to chemicals and moisture are highly valued, making them suitable for long-term wear by healthcare professionals. Also, nanoparticles incorporated into acrylic fibers can enhance their antimicrobial activity, improve drug delivery, and enable targeted therapies. Furthermore, the increasing awareness about hygiene and safety in healthcare, coupled with the expansion of healthcare infrastructure globally, drives the demand for medical textiles made from acrylic fibers.

Why did the Asia Pacific capture a Major Share of the Market in 2024?

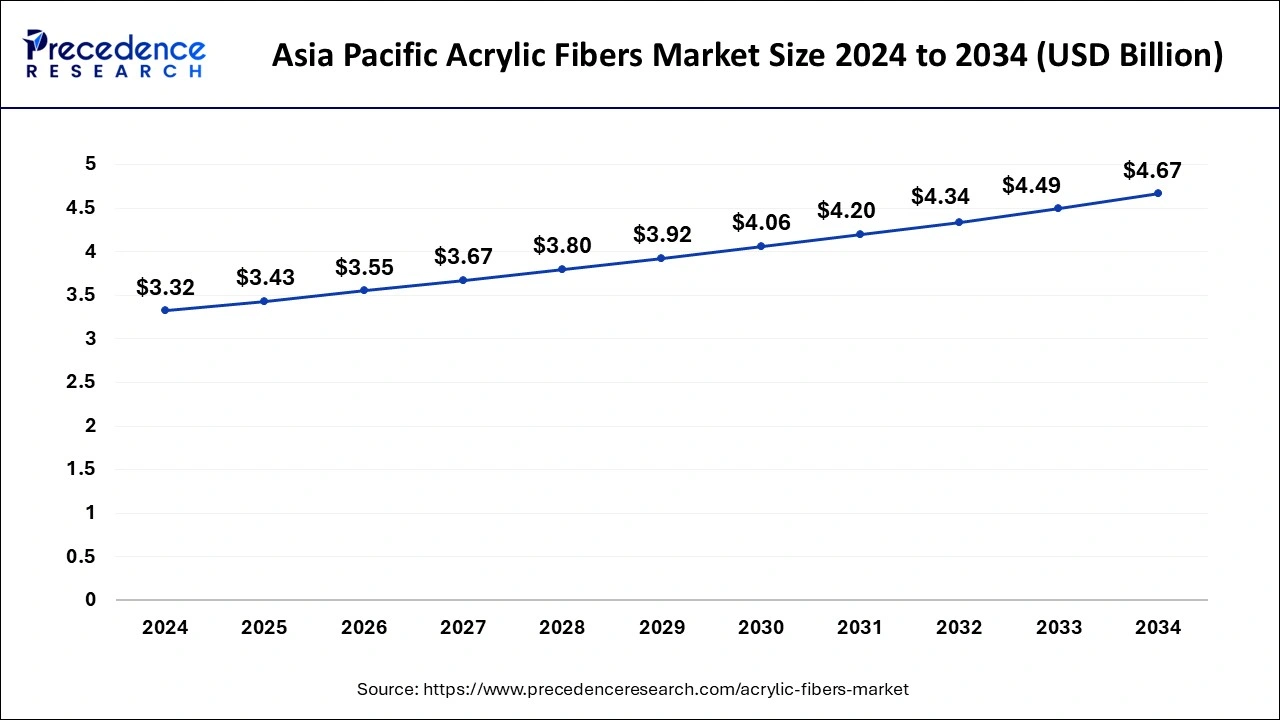

The Asia Pacific acrylic fibers market size is exhibited at USD 3.43 billion in 2025 and is projected to be worth around USD 4.67 billion by 2034, growing at a CAGR of 3.47% from 2025 to 2034.

Asia Pacific held the largest share of 60% in the market in 2024. The region's acrylic fibers market has been expanding significantly, mostly due to rising demand from end-use sectors such as home furnishings, clothing, and textiles. Major contributors to this rise were nations like China, India, and Japan, whose booming industrial sectors and vast bases of textile production played a significant role.

Due to its well-known qualities of warmth, softness, and resilience to chemicals and sunshine, acrylic fibers are used in a variety of products, such as outdoor fabrics, carpets, blankets, and apparel. The need for the acrylic fibers market has been fueled by the region's expanding population, rising levels of disposable income, and evolving consumer habits.

Innovative Technologies & Other Progressions: Supports the China Market

A major share of the Chinese market is driven by persistent innovations in automated dyeing technologies that optimise performance characteristics such as color consistency, UV resistance, and fade resistance, mainly in dyed staple acrylic fibers. Additionally, China has a major hub for ACN, and it is further expanding its capacity, while Sinopec, Zhejiang Petrochemical, and Jilin Petrochemical are playing a significant role in this progression.

Wider Adoption by Various Kinds of Users is Fueling North America

North America is observed to grow at a notable rate in the acrylic fibers market and is expected to maintain this dominance during the forecast period. In the textile business, acrylic fibers are commonly utilized to make a wide range of goods, including blankets, carpets, furniture, and clothing. Textile makers use acrylic fibers because of their versatility and qualities, such as warmth, softness, and colorfastness. Non-woven textiles, which have uses in the filtration, automotive, building, and healthcare sectors, are also made from acrylic fibers.

As acrylic fibers are more affordable, easier to maintain, and have better performance qualities than natural fibers like wool and cotton, they are frequently employed in their place. North America's acrylic fibers market is doing well thanks to expansion in a number of end-use sectors, including clothing, home furnishings, automotive, and healthcare.

Emergence of Advanced Blending: Leverages the U.S. Market

In the coming era, the U.S. market will see the highest growth, driven by numerous manufacturers blending acrylic with other natural and synthetic fibers (such as wool, cotton, or recycled polyester) to manage cost, feel, and performance. Acrylic-wool blends are increasingly used for premium knitwear and winter apparel due to their softness, warmth, and durability.

A Surge in Initiatives is Driving Europe

The acrylic fibers market in Europe is having a significant expansion, due to the merging of the EU-funded REACT (REcycling of Waste ACrylic Textiles) project of a collaborative European effort focused on the determination of ecological and economic processes to treat and recycle acrylic textile waste. As well as the global leader, Asahi Kasei unveiled LASTAN, a non-woven fabric from specialized fire-retardant acrylic fiber for escalated safety applications.

Strengthening Sustainability Focus: Elevates German Market

Nowadays, many German chemical and textile industries are widely shifting towards greener polymers and eco-conscious innovations. This prominently focuses on the utilization of recycled acrylic yarns and closed-loop production systems. Meanwhile, certifications like OEKO-TEX and bluesign are assisting in ensuring traceability and sustainability.

Acrylic Fibers Market: Value Chain Analysis

- Feedstock Procurement

It mainly involves sourcing acrylonitrile, the key monomer, followed by other monomers.

Key Players: INEOS Group Limited, Ascend Performance Materials, Formosa Plastics Corporation, etc. - Compound Formulation and Blending

This has been stepped by the creation of a highly viscous polymer solution, called "spinning dope," which is then spun into fibers, and the use of PAN.

Key Players: Dralon GmbH, Indian Acrylics Limited, Sinopec, etc. - Regulatory Compliance and Safety Monitoring

The player mainly focuses on controlling exposure to acrylonitrile during manufacturing and ensuring the safety of the final consumer product through stringent standards and certifications.

Key Players: OSHA, EPA, BIS, CPCB, Bureau Veritas, SGS, etc.

Top Companies and Their Contributions & Offerings

|

Company |

Strategic Focus |

Offering / Strength |

Impact on Market Growth |

|

Aksa Akrilik |

Scale leadership & integrated production |

World's largest single-site acrylic fibre capacity, plus technical & solution-dyed grades |

Drives cost-efficient volume and innovation in high-value acrylic segments globally |

|

Dralon GmbH |

Sustainability & specialty innovation |

Wide range of dry- and wet-spun acrylics, including microfibers and no-pilling types |

Supports premium, long-life textile growth and reduces environmental footprint |

|

Aditya Birla Group |

Green and traceable supply chain |

Branded Birlacril and Regel recycled acrylic fibres with blockchain-based traceability |

Expands sustainable fibre demand and trust among eco-conscious brands |

|

Jilin Chemical Fiber |

Domestic leadership & vertical integration |

Large-scale acrylic fibre capacity; also produces rayon, carbon fibre, and yarns |

Strengthens supply in China and supports diversified downstream growth |

|

TAEKWANG Industrial |

Regional scale and feedstock integration |

High-volume acrylic fibre production in Asia |

Meets growing Asia-Pacific demand and boosts global capacity balance |

Other Acrylic Fibers Market Companies

- Exlan Japan Co. Ltd.

- Kaneka Corporation.

- Indian Acrylics Limited.

Recent Developments

- In February 2024, Reliance Industries Limited (RIL) is excited to announce the launch of ECOTHERM, a game-changing product that has the potential to completely transform the textile industry and to offer a sneak peek at the Circular Design Challenge's (CDC) global growth. The distinguished "Reliance Sourcing Solutions Pavilion" at BharatTex 2024 is the site of the launch.

- In November 2022, Thai Acrylic Fiber Co Ltd. (TAF) released a new film that promotes recycling pre-consumed acrylic fibers as a means of waste management in the textile and garment industry. The newest fiber brand, Regel Fiber, promotes recycled acrylic fibers as a green solution for handling waste from the clothing sector.

Segments Covered in the Report

By Fiber Type (US$ Billion & Tons)

- Staple Fibers

- Tow (Tow-Dyed) Fibers

By Dyeing Method (US$ Bn)

- Acid Dyeing

- Gel Dyeing

- Undyed

By Blending (US$ Bn)

- Wool Blends

- Cotton Blends

- Others

By End-Use Application (US$ Bn)

- Apparel

- Knitwear (sweaters, pullovers, cardigans)

- Sportswear / Activewear (tracksuits, leggings)

- Casual Wear (shirts, dresses, t-shirts)

- Workwear / Uniforms (industrial clothing)

- Winter Clothing (jackets, scarves, gloves)

- Accessories (socks, hats, mittens)

- Home Textiles

- Blankets & Throws

- Curtains & Drapes

- Upholstery Fabrics

- Bed Linen (when blended)

- Rugs & Carpets

- Craft & Hobby Materials

- Knitting yarns

- Handicraft supplies

- Automotive Industry

- Car Seat Upholstery

- Headliners & Trunk Liners

- Carpets & Mats

- Interior Panels (blended with synthetics)

- Insulation Fabrics

- Construction Industry

- Thermal Insulation Materials

- Geotextiles

- Soundproofing Panels (blended)

- Reinforcement Fabrics (for composites)

- Filtration and Separation

- Industrial Filter Fabrics

- Liquid and Gas Filtration Media

- HVAC Filter Layers

- Dust Collection Systems

- Aerospace and Defense

- Flame-Retardant Protective Clothing

- Thermal Insulation Layers

- Reinforced Composite Textiles

- Tactical & Camouflage Fabrics

- Healthcare Industry

- Medical Nonwovens (e.g., disposable gowns)

- Wipes and Cleaning Cloths

- Surgical Mask Linings (blends)

- Bedding & Underpads (disposable types)

- Consumer Goods & Others

- Outdoor Fabrics (awnings, canopies)

- Recreational Textiles (camping gear, sleeping bags)

- Nonwoven Consumer Products (cleaning cloths, craft items)

- Toy Stuffing & Soft Toys

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client